Paypal: This industry leader is a steal

Margin expansion, industry leadership, and trading at 64% of its fair value make this pick a no-brainer.

Born in 1998, this company has had its fair share of escapades—merging with a rival, getting scooped up by a bigger fish, and eventually being spun back out on its own.

It now navigates a crowded battlefield of established competitors and nimble upstarts, yet its knack for growing in its field while fattening its margins makes it an enticing pick. And with shares currently trading well below their true worth, this stock has become the newest addition to SVIF USA.

The company

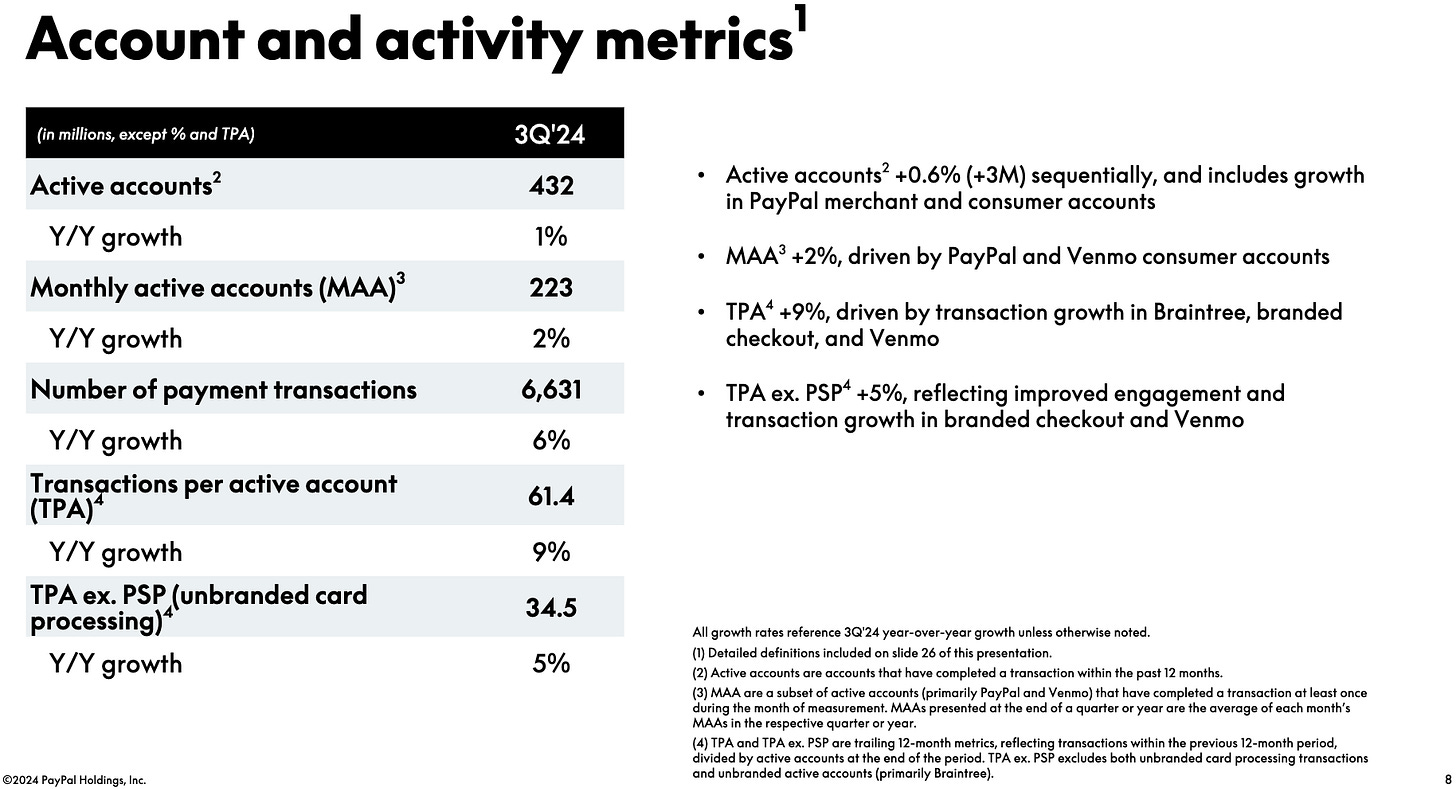

PayPal Holdings, Inc. (PYPL) is a leader in online payments, connecting buyers and sellers in more than 200 countries. With 432 million active users, PayPal facilitates transactions ranging from peer-to-peer payments (via PayPal and Venmo) to 'Buy Now, Pay Later' solutions.

Strengths Rooted in History and Innovation

The Business Wars series on eBay vs. PayPal explores their rivalry and eventual partnership in transforming online commerce. eBay revolutionized auctions but struggled with secure payments, while PayPal emerged as the go-to solution, sparking a battle as eBay launched its competing service, Billpoint. PayPal’s superior fraud prevention and user adoption led to its 2002 acquisition by eBay for $1.5 billion, turning rivals into allies. Over time, as PayPal outgrew eBay’s ecosystem, tensions led to its 2015 spin-off, solidifying its role as a leading independent fintech giant.

By the way, if there is only one podcast that would improve your business acumen, it would be Business Wars, highly recommended.

Recently, PayPal has levelled up. In 2024, PayPal introduced advanced AI tools to streamline buying and selling. It’s all part of the move towards online payments and the big boom in e-commerce.

Feel free to click the like button on this post so that more people can discover it on Substack.

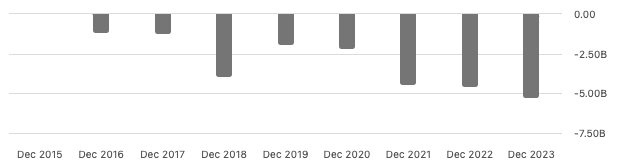

A Mixed Bag of Acquisitions

PayPal’s acquisitions have been a mixed bag. Snapping up iZettle in 2018 for $2.2 billion helped them tap into in-person transactions, and Honey in 2020 for $4 billion was a strategic move.

However, PayPal’s 2015 acquisition of Xoom, which focuses on international money transfers, did not align with its core digital payments business. Also, PayPal seemed to have overpaid for Xoom ($890 million). Nearly a decade later, PayPal plans to divest Xoom.

Refocus on shareholder value

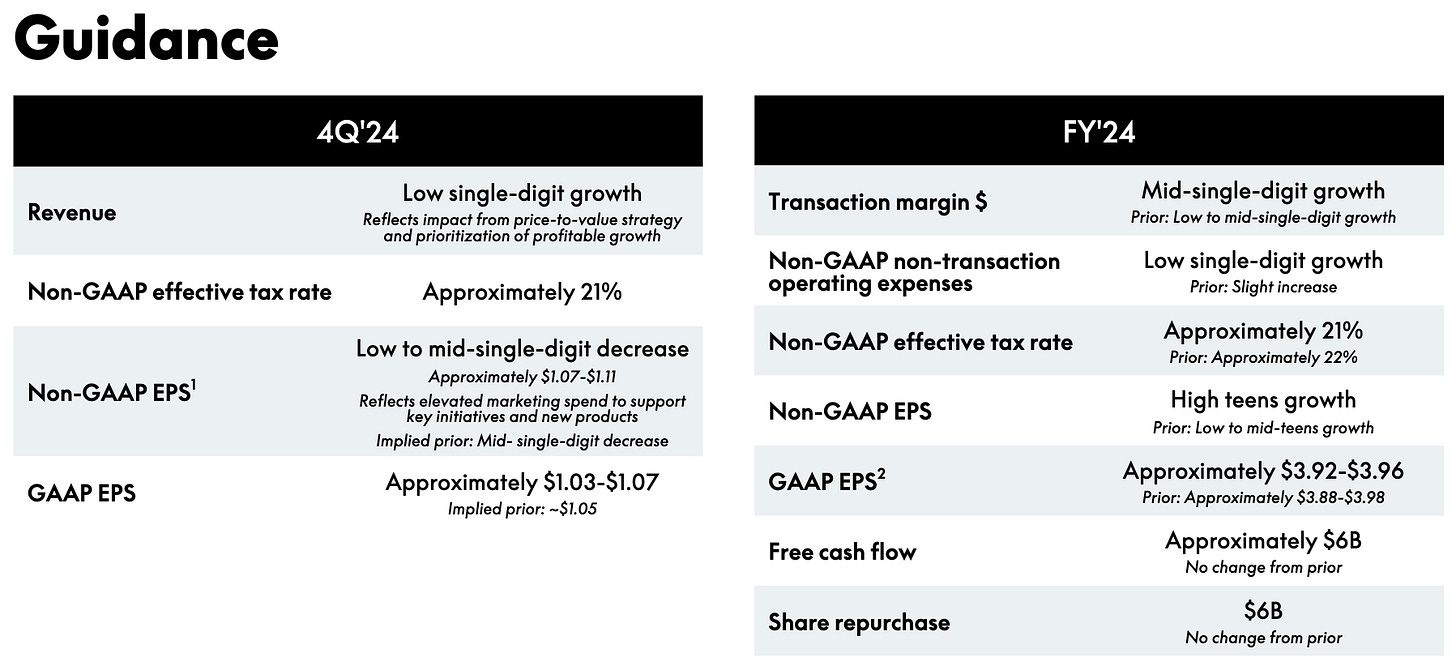

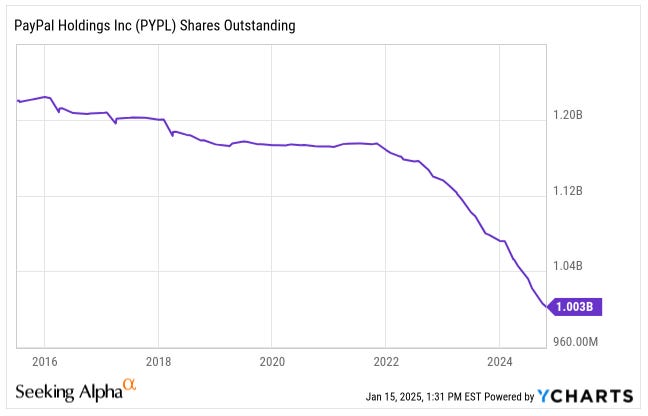

These days, it looks like PayPal is leaning more toward giving cash back to shareholders rather than going on a buying spree.

Repurchase of Common Stock

Paypal guided to repurchase $6 billion shares in 2024.

As a result, the share count has decreased by ~18% since 2016 to 1 billion outstanding shares.

Venmo

Venmo has potential but struggles to generate significant profits. To handle the pressure, PayPal decided to go lean and mean—cutting costs, keeping current users hooked, and picking its innovation battles wisely. PayPal now allows customers to choose funding methods, aiming to retain users post-pandemic.

The Road Ahead

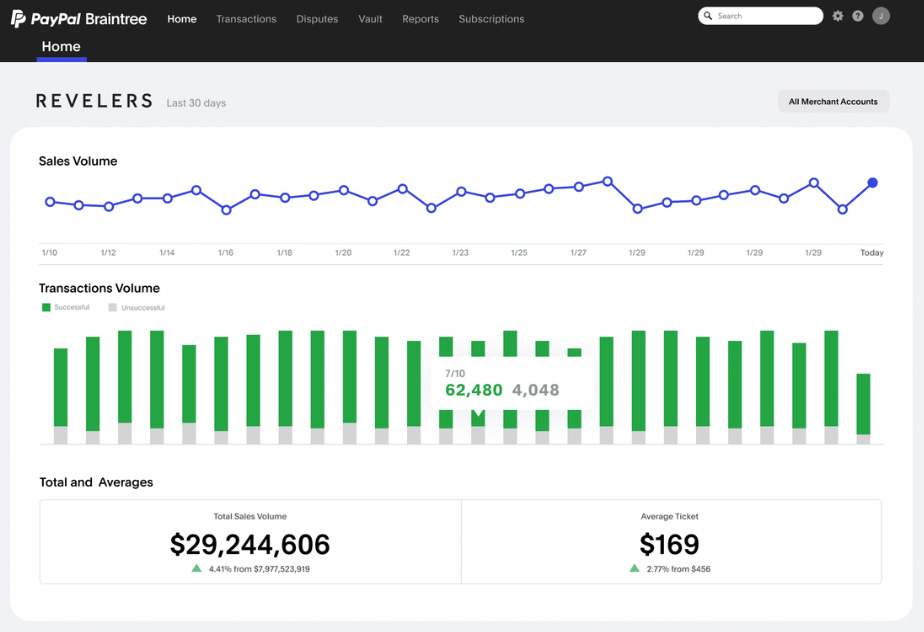

PayPal’s new CEO Alex Chriss, who came on board in September 2023 after a winning run at Intuit, is all about streamlining and boosting profits. Chriss is zeroing in on what PayPal does best—like Braintree’s fast growth and its one-of-a-kind role in e-commerce—to keep the company competitive in the ever-changing payments scene.

The opportunity

Runway for Growth in Electronic Payments

Electronic payments are still catching on worldwide. McKinsey has a great report on the outlook of electronic payments.

The future of electronic payments is bright, with global revenues hitting a record $2.2 trillion in 2022, driven by innovations like instant payments and digital wallets. Cash usage is steadily declining, particularly in countries like India and Brazil, where networks like PIX are transforming the landscape. Cross-border payments are growing rapidly, while technological advancements such as APIs, generative AI, and embedded finance are defining the next era of payments.

As the industry moves into a "Decoupled Era”, where payments become increasingly disconnected from traditional accounts, global growth is projected at 6–8% annually over the next five years, highlighting a global shift towards more efficient and technology-driven transaction methods.

PayPal’s in a great spot to ride this wave. Programs like PayPal Everywhere simplify online and in-store payments, attracting new users and encouraging broader adoption.

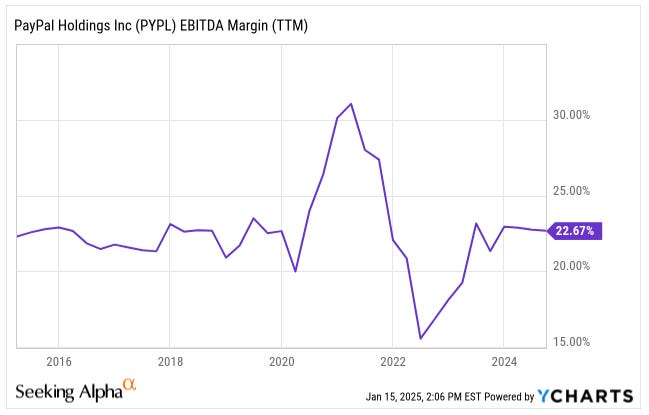

Scalable Business Model with Margin Expansion Potential

PayPal’s business is super scalable—when transactions go up, the extra costs stay low. Handling more payments—like the massive $422.6 billion TPV reported in Q3 2024—lets PayPal run more efficiently. Cool features like PayPal Fastlane make checkout smoother, cutting down on abandoned carts and boosting conversions. As PayPal keeps fine-tuning its game and using AI tools, its margins should keep getting better, especially since they’re already killing it in a fast-growing market.

A Unique Asset in Online Payments with E-Commerce Growth

PayPal’s years of experience with online payments make it a key player as online shopping keeps growing. The company’s well-established connections with businesses and shoppers, along with its strong fraud protection, help create a secure, reliable payment system. Partnerships—like teaming up with Shopify in 2024—show how PayPal stays a go-to payment option for businesses, making it easy for more platforms to sign on. Plus, with physical and online shopping blending more than ever, PayPal is in a great spot to keep offering smooth payment solutions wherever you shop.

Share the Love! Invite friends to join our community and earn rewards!

The competition

PayPal might be a big name, but it's got plenty of competition breathing down its neck. Heavyweights like Apple Pay and up-and-comers like Stripe and Adyen are stepping on its turf. A search on Seeking Alpha identified 43 competitors. This figure only accounts for publicly traded competitors. For instance, Stripe, which processes payments for Substack, remains privately held.

Visa and Mastercard dominate as global payment networks, leveraging their scale and infrastructure, while expanding into digital and instant payments through initiatives like Visa Direct and Mastercard Send. Meanwhile, mobile wallets like Apple Pay and Google Pay, integrated into their ecosystems, threaten PayPal’s digital dominance. To stay competitive, PayPal is focusing on expanding its product offerings, such as Buy Now, Pay Later solutions and AI-driven fraud prevention, while leveraging partnerships with e-commerce platforms like Shopify. Despite its strong foothold in online payments, PayPal must continue to innovate and scale if it hopes to remain competitive.

The valuation

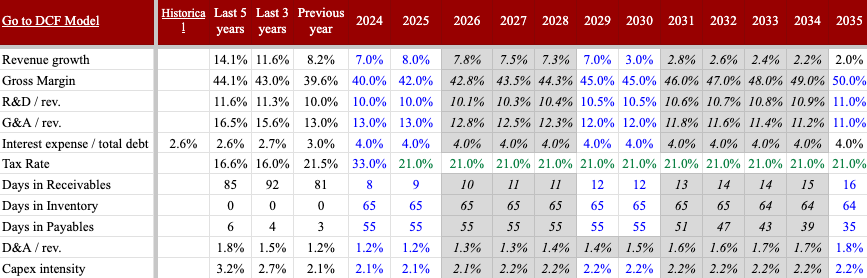

Valuing the company with a DCF model tells me the fair value of the shares at $142, 58% upside as of today.

The DCF is based on a cost of capital of 7.7%. This is based on the industry unlevered beta of 0.721, risk-free rate of 4.0%, equity premium of 6.0% and a long-term debt-to-capital ratio of 35%

I expect revenue growth to be in the mid-single digits driven by the tough competition from the big 2 (Visa and Mastercard) and the smaller players.

However, I believe AI would be a game changer for PayPal reducing its costs. I reflect that in the margin expansion.

AI can play a pivotal role in helping PayPal reduce costs by streamlining operations, improving fraud detection, and optimizing customer interactions. One major area is fraud prevention and risk management, where AI-powered systems can analyze vast amounts of transaction data in real-time to identify unusual patterns and detect fraudulent activities. These systems are more accurate than traditional approaches, minimizing losses from fraud and reducing false positives that often lead to unnecessary operational costs. Additionally, AI can optimize payment routing, selecting the most cost-effective pathways for processing transactions, which lowers interchange fees and improves overall efficiency.

Another critical application of AI is in customer service, where chatbots and virtual assistants can handle a high volume of inquiries, reducing the need for large support teams. These AI tools use natural language processing to provide personalized and accurate responses, cutting costs while enhancing customer satisfaction. Beyond customer-facing benefits, AI can streamline internal processes, such as compliance checks, account verifications, and financial reporting, reducing the reliance on manual efforts and minimizing errors.

The risks

Blurring Lines Between Online and Point-of-Sale Transactions

PayPal faces challenges as online and in-person payments converge. With omnichannel shopping on the rise, big players like Apple Pay and Google Pay are making serious moves. They’re deeply tied into their ecosystems and are beefing up their game in both digital and in-store transactions. This could make it harder for PayPal to stand out or hold onto its market share. If PayPal can’t step up its game, it might find its profits squeezed and future growth limited.

Geopolitical Risks and Favoritism Towards Local Players

In emerging markets, local payment platforms like Alipay and WeChat often get the government’s stamp of approval. This makes it tough for PayPal to break in or grow because of the rules and roadblocks they face. On top of that, political tensions, protectionist moves, or wild currency swings just add to the headache, keeping PayPal from cashing in on these fast-growing international markets. Exclusion from these markets could limit global growth, making PayPal reliant on mature markets.

Uncertain Monetization Potential for Venmo

Venmo, one of PayPal’s standout products, has been growing fast in terms of users but still doesn’t bring in much profit. Even with new features and ways to make money—like charging for instant transfers or business payments—its long-term earning potential is still a big question mark. People expect peer-to-peer services to be free, which makes it tough to turn a solid profit. On top of that, more competitors are jumping into the peer-to-peer payment game, so Venmo’s impact on PayPal’s overall bottom line might stay pretty limited.

If you have any questions, add them in the comment section and I will answer them as soon as possible.

Happy investing,

~ George

Remember

The portfolio does not reflect today’s trades. Today’s trades will be reflected before tomorrow's market opening.

I used a blended beta of 50% for Information Technology [0.80] and 50% for Financials non-banks [0.38] and used the Blume’s beta adjustement.