Argan (AGX) Deep Dive: Why I’m Still Bullish After a 87% Run

A detailed deep dive into Argan’s growth story, updated DCF valuation, Q1 earnings, insider selling, and what I’m doing with my position.

Update:

Jan14’26: Closed 🚪 AGX position with a +166% gain.

Dec7’25: Q3’26 Earnings Results & revised target price ($274 → $374)

Sep7’25: Q2’26 Earnings Results & revised target price ($290 → $274)

Jun8’25: Q1’26 Earnings Results

On December 23, 2024, I shared an article on my Patreon (before migrating to Substack) and LinkedIn, naming Argan, Inc. AGX 0.00%↑ as my top stock pick for 2025. My thesis was that this under-the-radar power infrastructure company was about to ride a wave of booming energy demand, from data centers and EV charging to manufacturing reshoring, all while being financially rock-solid and undervalued.

Fast forward to today: Argan’s stock price has increased by 57% since that article and 87% since its inclusion in the portfolio.

In a matter of eight months, Argan went from obscurity to delivering outsized gains, proving that sometimes the “boring” infrastructure plays can be real portfolio rockstars.

But after such a stellar run, what’s next for Argan?

Is the stock still a buy, or have we already seen the best it has to offer?

In this ultra deep dive (+13,000-word stock analysis), I’ll revisit my original investment thesis, dissect what came true and what I missed, dig into Argan’s latest results (the company just posted blowout Q1 FY2026 numbers), evaluate the industry outlook (spoiler: the “electrification of everything” trend is only getting stronger), review Argan’s competitors and unique edge, update my valuation (DCF target now $290, up from $278), and even discuss the heavy insider selling that’s been happening.

By the end, you should have a clear picture of Argan’s business, its prospects, and whether AGX stock still deserves a spot in the portfolio after its big move.

While I remain bullish on Argan and continue to view it as a core holding in my portfolio, I’ve decided to trim my position slightly. After an 87% surge, the risk-reward profile isn’t quite as compelling as when I first flagged it in December. It is still attractive, but less asymmetric. I’m reallocating a portion of the gains into other opportunities with higher upside potential, which I shared in my latest trade alert.

Table of Contents:

What Does Argan Do?: Powering the “Electrification of Everything”

Q1 2026 Results: Blowout Quarter and Record Backlog Fuel the Rally

Industry Outlook: Infrastructure Supercycle: Why Power Demand & Investment Are Skyrocketing

Competitors and Argan’s Edge: How a Small Company Outshines the Big Players

Insider Selling: Lots of Execs Cashing Out, A Warning Sign or Business as Usual?

Final Thoughts: Still Constructive on Argan, But Reducing Exposure

Elevator Pitch

Argan is a cash-rich builder of power plants and energy infrastructure that’s benefiting from unprecedented demand for reliable electricity (thanks to AI, data centers, EVs, and an aging grid).

The company has no debt, a record $1.9 billion backlog, and fat profit margins, a rare combo in construction. The stock has already surged from $40s in 2019 to $220 as of now, but with growth accelerating, I believe it still has room to run (my updated fair value is ~$290).

What Does Argan Do?: Powering the “Electrification of Everything”

AGX may not be a household name, so let’s start with what this company actually does. Argan is essentially a specialty construction firm focused on building large-scale energy projects. If a utility or industrial client needs a power plant or major electrical infrastructure built, Argan’s team steps in to engineer, procure, and construct the facility from the ground up. Think natural gas-fired power plants, solar farms, biomass power stations, wind farm infrastructure, and even high-voltage industrial facilities.

The company operates through three segments.

Power Industry Services (83% of revenue)

This is Argan’s bread and butter. Through its main subsidiary Gemma Power Systems, Argan builds power generation plants (traditional gas-fired plants as well as renewable energy projects like utility-scale solar and biomass).

Gemma has an impressive track record; it has constructed over 16,000 MW of energy capacity across gas, solar, and biofuel facilities, including some of the most advanced combined-cycle gas plants in the U.S. If you see a new 500 MW natural gas plant or a big solar farm going up, there’s a chance Argan’s crew is on site making it happen.

Industrial Construction Services (15% of revenue)

This segment (operated by Argan’s subsidiary TRC) provides construction and maintenance services for industrial and manufacturing sites. In practice, TRC handles things like setting up process piping, installing equipment, and performing electrical and mechanical work for factories, chemical plants, pulp & paper mills, water treatment facilities, and so on.

TRC is regionally focused in the U.S. Southeast, where a lot of new manufacturing (think EV battery plants, petrochemical facilities, etc.) is being built. This business benefits from the onshoring and expansion of U.S. manufacturing. When a company builds or expands a plant in, say, North Carolina or Georgia, TRC can win contracts to do the construction and installation work.

Telecommunications Infrastructure Services (2% of revenue)

This is Argan’s smallest segment, and truthfully, it’s not a big needle-mover. It involves building and installing wireline and fibre optic infrastructure and providing wiring services for telecom and utility customers (often on secure government sites).

It’s a niche operation for specialized projects (e.g. wiring a military base’s communications network). This segment is barely profitable (it had a slight loss in the latest quarter) and represents a tiny slice of the business. Consider it a legacy sideline, Argan’s real focus is on power and industrial projects.

In summary, Argan is an engineering & construction company that builds the critical infrastructure behind the energy grid and industrial base. They aren’t making consumer gadgets or sexy software, they’re building the physical backbone (power plants, electrical systems, factory infrastructure) that keeps our modern economy running.

Despite its unglamorous profile, Argan’s business is crucial and currently in high demand. The company is based in Virginia but serves customers across the U.S. and even in the UK/Ireland for some projects. If you’ve never heard of Argan, it’s partly because they operate in the background (no splashy consumer brand) and partly because it’s a relatively small-cap company (~$3B market cap as of this writing). But as we’ll see, AGX has been punching far above its weight, winning huge contracts and outperforming many larger competitors in its niche.

Looking Back: My Original Thesis vs. Reality

Let’s revisit the key points of my original bullish thesis for Argan from late 2024, and see how they’ve played out so far. Spoiler: a lot of it came true (and then some), though there were also a couple of things I underestimated.

#1. High-Growth Mode with Big Backlog and Improving Margins

In December, I noted that Argan had finally hit its stride with project execution and was delivering rapid growth. The company’s revenue was soaring (57% y/y growth in the quarter before my article), and its project backlog had swelled to $800 million (equal to a full year’s revenue), providing visibility into future sales. Crucially, profitability was improving too: AGX had doubled its EBITDA margins to 14.6% by Q3 FY2025 (up from 7.4% a year prior) as new projects ramped up and overhead was absorbed.

What happened: This high-growth thesis has been resoundingly validated. AGX continued its streak of blowout results into Q4 and the latest Q1 (more on Q1 shortly). Revenues for full FY2025 (year ended Jan 31, 2025) jumped 52% to $874 million, and then in Q1 FY2026 they rose another 23% y/y.

The backlog I was so excited about? It didn’t just stay high, it exploded to new records. As of April 30, 2025, Argan’s project backlog hit $1.86 billion, up from ~$800M a year earlier. That is an incredible 132% backlog growth in about 12 months, reflecting a slew of new contract wins.

In fact, the company’s CEO said on the latest conference call that they expect the backlog to surpass $2 billion later this year as more projects are added. David Hibbert said,

The pipeline remains strong, and we're very bullish on being able to continue to add to the backlog. Currently, as you can see from our record backlog of $1.9 billion … we added several jobs during the quarter… But in the short-to-medium term, we expect to add several power industrial jobs over the course of the next 6 months, which should put us significantly over $2 billion in backlog later this year… we believe demand will remain strong for the next decade and beyond, and this is underscored by the fact that the OEMs are starting to fill 2030 gas turbine slots as they are primarily sold out of earlier years.

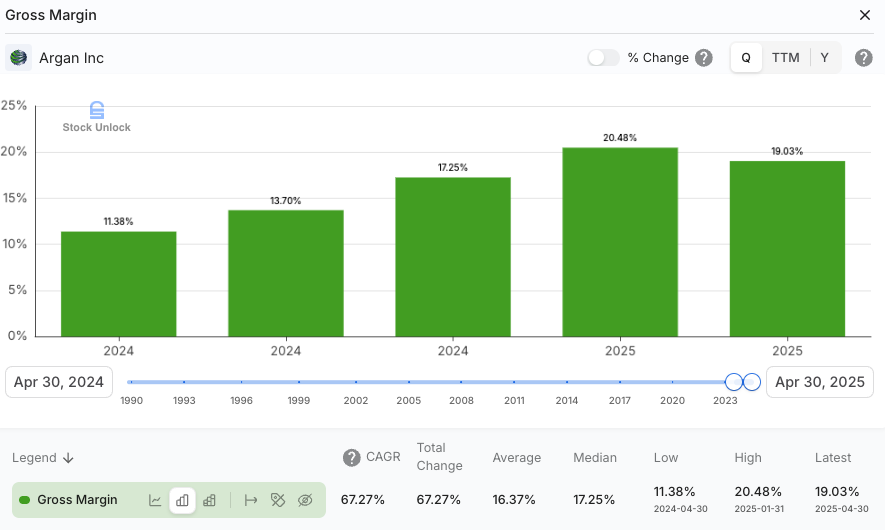

Notably, Argan’s profit margins have also improved beyond expectations. In my original writeup, I was impressed that adjusted EBITDA margin had reached ~14-15%.

Now the company is doing even better: in Q1 FY2026, gross margin was 19.0% (versus 11.4% in the prior-year period), and EBITDA margin hit 15.6%.

To put it simply, AGX has kept revenue growing and managed to earn more profit on each dollar of sales than before, a powerful combination. This margin expansion reflects strong execution on projects (often towards the end of a project, efficiencies and cost savings boost margins) and a more favourable project mix.

In the words of Argan’s CEO, David Watson, it was “another great, solid gross profit quarter” driven by strong execution and a changing mix toward higher-margin projects. As a result, quarterly EPS has skyrocketed; AGX earned $1.60 per share in Q1, versus only $0.58 a year prior. When a construction firm is tripling its EPS y/y, you know something is going very right operationally!

#2. Demand Supercycle for Energy Infrastructure (Data Centers, EVs, Reshoring)

My second thesis point was that AGX is a direct play on surging energy demand caused by megatrends like the proliferation of data centers (cloud computing, AI), the adoption of EVs, and the reshoring of manufacturing to the U.S.. All these trends require massive investments in power generation and grid infrastructure, and Argan’s “energy-agnostic” capabilities (they can build gas plants, solar farms, battery storage, etc.) position it to benefit broadly.

In late 2024, this was more of a forward-looking narrative. Data center power usage was rising, EV charging buildout was just accelerating, and new factories were being announced, all pointing to a coming capex boom for energy infrastructure.

What happened: This thesis has absolutely played out, and arguably the tailwinds are even stronger now. We are indeed in an energy infrastructure supercycle, and Argan’s backlog and commentary reflect that. CEO David Watson highlighted that for the first time in decades, U.S. electricity demand is steadily rising (after years of stagnation) and is coinciding with the retirement of many aging power plants, creating an urgent need for new capacity. He specifically cited the strain on power grids from “the building of data centers, the onshoring of complex manufacturing, and an increasing amount of EV charging activity”, saying these trends are driving a robust pipeline of projects. In short, the exact drivers I identified are now showing up in Argan’s order book:

The growth of cloud computing and AI is fueling a boom in data centers, which are extremely power-hungry. Generative AI workloads, in particular, consume huge amounts of electricity. Morgan Stanley projects AI-related power demand will grow 70% annually through 2027. All these new data centers (and their backup power systems) need to be built, a boon for firms like Argan. Management notes that “AI and cloud computing [are] driving record electricity consumption” and that Argan sees a “nice opportunity” here.

EV adoption continues to accelerate, and with it, the need for charging infrastructure and more generation capacity. By 2040, EV usage in the U.S. is projected to grow 20-fold, which would increase annual electricity load by an astonishing ~444,000 GWh (from just 24,000 GWh in 2023). This implies a need for many new power plants over the coming decades. Government incentives (federal tax credits, state EV mandates) are turbocharging this trend. AGX is already feeling the impact. Some of its projects in development are likely tied to supporting EV battery factories and charging networks. As more EVs hit the road, utilities will need to expand capacity, meaning more work for Argan.

The manufacturing renaissance in America (partly driven by reshoring and huge federal programs like the CHIPS Act and Inflation Reduction Act) is another demand driver. Since 2021, companies have committed over $500 billion toward new U.S. factories for semiconductors, batteries, solar panels and more. Each of those facilities needs reliable power infrastructure, often including dedicated on-site power generation or substantial grid upgrades. Argan’s industrial segment (TRC) is tapped into this, especially in the Southeast U.S., where many new plants are being built. For instance, TRC’s backlog recently grew to $91 million thanks to onshoring-related projects, and the CEO noted “solid demand… as companies onshore or expand U.S. manufacturing operations”.

Renewable energy buildout and grid reliability needs also play a role. Even as wind and solar farms are being constructed (some by Argan), the intermittency of renewables means backup power and grid stabilization projects are crucial. Many regions are facing grid reliability issues as older coal/gas plants retire. As a result, there’s heightened demand for natural gas “peakers” and battery storage projects to ensure 24/7 power. Argan is uniquely positioned because it builds today’s energy (gas plants) and tomorrow’s energy (renewables + storage). Management sees the current cycle of power plant construction as still early: “The energy transition and electrification trend will create a wave of investment in energy infrastructure in the coming years, and Argan will strongly benefit”.

The bottom line is that all the macro trends I cited have not only continued but intensified. This is directly evidenced by Argan’s backlog composition: about 95% of its $1.9B backlog is tied to electric power projects, with 67% in natural gas and 28% in renewables (the remaining ~5% industrial). In other words, virtually all of Argan’s business is driven by the “electrification of everything” theme.

The company’s marketing materials explicitly highlight that they are “enabling the electrification of everything” from EV chargers and data centers to replacing decades-old power plants. So this piece of the thesis, that Argan would ride a huge secular demand wave, was spot on. If anything, I underestimated how quickly this demand would translate into signed contracts for Argan. (Case in point: in April 2025, Argan got full notice to proceed on a single new gas plant in Texas that added $500+ million to backlog in one go, more on that in a moment.)

#3. Best-in-Class Balance Sheet = Flexibility and Resilience

Another pillar of my original thesis was Argan’s pristine balance sheet. They had (and still have) zero debt and a huge cash pile (which was around $500 million, or ~70% of total assets at the time). I argued that this net cash position gave Argan a big advantage over competitors as it can bid on projects without worrying about leverage, endure economic ups and downs, and even pursue growth opportunities (or acquisitions) others can’t. I also noted that among peers, Argan’s financial position was extraordinary (e.g. a smaller peer, Limbach Holdings LMB 0.00%↑, had a similarly debt-free balance sheet but only $6M net cash versus Argan’s $504M).

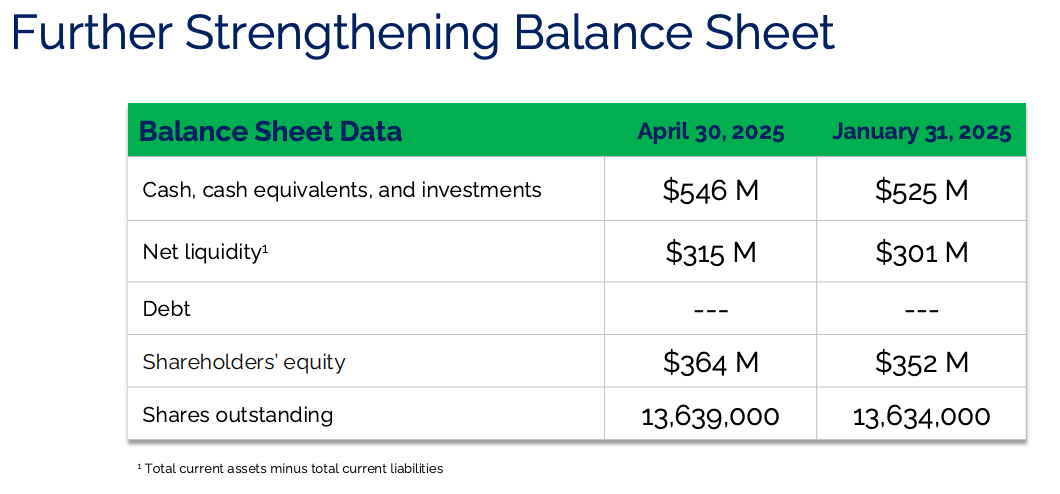

What happened: Argan’s balance sheet remains rock-solid, and the company has indeed leveraged its financial strength in shareholder-friendly ways. As of the end of Q1 FY2026, Argan’s balance sheet boasted $546 million in cash and investments and no debt. Despite the company actively returning cash to shareholders, the cash hoard grew in the last quarter (up from $525M at Jan 31) thanks to strong profits.

Argan’s shareholders’ equity is now $364M, and the company’s working capital (or “net liquidity” as they call it) is $315M, plenty of dry powder to support large projects and bonding requirements.

What has Argan done with its cash?

For one, it pays dividends and buys back stock, something many growth companies don’t do.

In Q1, Argan raised its quarterly dividend to $0.375 per share, a 25% increase from a year ago. That’s a ~$1.50 annual dividend, giving the stock about a 0.7% yield at current prices. Not huge, but a nice bonus given the growth profile. The dividend has grown steadily (it was $1.28/year in 2024 and I project it to be at least $1.50 in 2025, then rising further in management’s plans).

Additionally, Argan has been aggressively repurchasing shares: the company bought back ~$8.4 million worth in Q1 alone. In March 2025, the Board expanded the share buyback authorization to $150 million. To put that in perspective, $150M is over 5% of Argan’s market cap, a significant potential shrinkage of the share count if executed fully.

This financial strength also translates into bonding capacity (for bidding on huge projects, clients often require performance bonds. Argan’s hefty cash makes sure it can get bonded easily, which smaller or debt-laden contractors might struggle with).

Importantly, Argan’s cash isn’t just sitting idle. Last year, Argan earned over $10 million in interest income thanks to higher interest rates on its cash holdings. This essentially boosts earnings with zero risk. Argan is not only immune to rising interest rates, but it also generates interest income from the high interest rates on its cash position. Few competitors have this luxury; many have debt and are paying interest, whereas Argan earns interest.

In short, Argan’s financial flexibility remains a huge strategic advantage. The company can afford to be picky with contracts (no desperation to take low-margin work just to service debt), invest in project development (they occasionally invest small amounts in power project developers to get a foot in the door, e.g. a $5M loan in FY2025 to support a project that could lead to an EPC contract), and return cash to us shareholders. This was central to my thesis and has proven true.

If anything, Argan’s balance sheet gave management the confidence to ramp up capital returns faster than I expected (I didn’t necessarily predict a big buyback authorization, but they delivered one). It’s also a safety net: should the market or economy turn south, Argan can weather it much better than most companies in the construction sector.

#4. Undervalued vs. Peers: The Re-rating Happened

My final point last year was that Argan’s stock was significantly undervalued, both relative to peers and on an absolute DCF basis. At the time, the stock was around $130-$140 and trading near the low end of the peer range on EV/EBITDA, etc. I did a DCF analysis that yielded a fair value of ~$278 per share, roughly double the market price then.

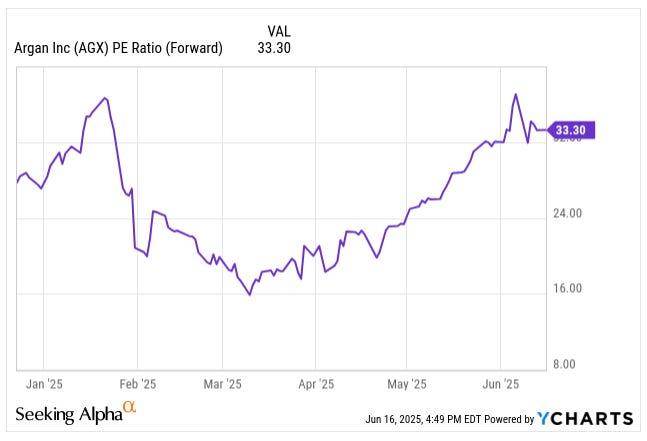

What happened: This is the area where things changed the most. The market clearly woke up to Argan’s story, hence the rally in the stock. AGX went from ~$130 in late 2024 to over $220 by mid-2025. So the valuation gap I noted has largely closed. Argan’s stock isn’t “cheap” anymore by traditional metrics; it’s actually quite rich. At around $220 per share, AGX is trading at roughly 33x forward earnings, which is well above the typical multiples for construction/engineering companies.

For example, the sector median P/E is closer to 22x, and Argan’s own 5-year average P/E is 23x. By EV/EBITDA, AGX is about 22x, double its 5-year average of 11x.

The market has re-rated AGX as a premium growth stock rather than a value stock. This is a testament to the company’s success as investors are now willing to pay up for its growth and quality. But it does mean that the easy money has been made. When I picked it at $118, the risk/reward was extremely skewed to the upside (and indeed we got a quick double-ish (+87%)). At $220, the calculus is different: expectations are much higher now, and any stumble could cause a sharp pullback.

That said, do I think it’s overvalued now?

Not necessarily. I’ll dive into an updated valuation in a later section (spoiler: my updated DCF yields $290/share, so still 32% above the current price). I tend to agree that Argan isn’t your average contractor and deserves a premium over peers. Its earnings growth (trailing EPS jumped from ~$2 in FY2024 to over $6 in FY2025) is more reminiscent of a tech stock than a construction firm. The company has also demonstrated it can sustain high margins in an industry where many peers struggle to break even on big projects.

To sum up this valuation point: Argan’s stock has already re-rated upward significantly, validating my call that it was undervalued. Going forward, the thesis transitions from “multiple expansion” to “earnings growth” as the main driver. The stock likely won’t double again on multiple expansion alone (it’s not going to 70x earnings!), so further upside will depend on Argan continuing to deliver strong results to grow into its valuation.

I’ll assess whether that’s likely (I think it is) and run updated numbers in the DCF section. But you should recognize that the risk profile today is different. Argan is priced as a growth stock, which means any disappointment could hit the stock hard (the flip side of a high P/E). This is one reason I’ll also highlight risks and insider selling later on.

In summary, the original thesis has played out almost to perfection: Argan’s growth accelerated, the industry tailwinds materialized, the balance sheet remained a pillar of strength, and the market rewarded the stock with a much higher valuation. My only “miss” was perhaps underestimating how quickly the stock would move as it achieved my initial price target far faster (and earlier in the cycle) than I anticipated. As a shareholder, I’m obviously thrilled with that outcome. But it does prompt the need to re-evaluate, is Argan still a compelling buy at these levels? That’s exactly why I’m doing this deep dive now.

Now, let’s zero in on Argan’s latest performance and the current state of the business.

Q1 2026 Results: Blowout Quarter and Record Backlog Fuel the Rally

Argan reported its Fiscal Q1 2026 earnings (for the quarter ended April 30, 2025) on June 4, and the results were nothing short of stellar. The company extended its trend of outperforming expectations, delivering strong growth and profitability that has undoubtedly contributed to the stock’s strength.

Revenue

$193.7 million for Q1, up 22.8% y/y (from $157.7M in Q1 last year). This topped analysts’ estimates (and essentially matched the high end of forecasts, with only a trivial $90K miss (basically a rounding error given the scale). The growth was driven by increased project activity across the board. Argan had more projects in execution this quarter than a year ago, thanks to all those backlog wins.

Profitability

Gross profit was $36.9M, more than double the $17.9M a year ago, with gross margin expanding to 19.0% (versus 11.4%).

This is a huge improvement in margins. As mentioned, management credited strong project execution and a favourable mix. One big contributor is a major gas plant project (the Trumbull Energy Center in Ohio, 950 MW) nearing completion, which likely contributed outsized profit as contingencies were released. Late-stage projects often boost margins.

CEO Watson acknowledged that margins have been “above expectations” the last two quarters and that they expect to exceed last year’s margin profile going forward . In other words, high-teens gross margins might be the new normal, not a fluke.

Operating income and net income saw dramatic jumps

Net income came in at $22.6 million for the quarter, up from $7.9M a year ago. That’s +186%, roughly tracking the gross profit jump, indicating overhead costs grew only modestly.

In fact, SG&A expenses were $13M vs $11M last year, showing that Argan’s overhead is being well-leveraged against the higher revenue. Diluted EPS was $1.60, compared to $0.58, up 176%. To put this in perspective, Argan earned more in one quarter ($1.60) than it did in the entire fiscal year 2021 ($1.51 EPS). That’s how fast earnings have ramped.

Backlog

Project backlog hit a new record of $1.856 billion. Just a quarter ago (Jan 31), backlog was $1.361B, so it jumped ~$495 million in three months. And a year ago it was around $800M, so it’s up ~132% y/y. This backlog figure was highlighted as a record in the earnings release for good reason, as it represents roughly 2.1x Argan’s FY2025 revenue, giving a lot of visibility into future growth.

The backlog got a big boost from one major contract: Argan received full notice to proceed (FNTP) on the Sandow Lakes Power Station project in Texas during Q1. This is a 1.2 GW(!) combined-cycle natural gas plant Argan had been selected for, but FNTP (essentially the real green light to start construction and recognize as backlog) added the project value into the backlog. This single project is likely worth on the order of $500–600 million (given its size).

Indeed, management said:

Our backlog reflects our receipt of full notice to proceed on our project with Sandow Lakes Energy Company, or SLEC, for a 1.2-gigawatt ultra-efficient combined cycle natural gas-fired plant in Texas.

And that the Sandow project “increased our backlog to a record $1.9 billion” . They also have other new awards, including some industrial jobs that brought the Industrial segment backlog to $91M (from ~$53M).

It’s worth noting how balanced and high-quality the backlog is. Per the investor presentation, 67% of the backlog is natural gas projects and 28% is renewable projects (the rest industrial/other).

This mix indicates Argan is winning in both traditional and clean energy, a strategic positive.

Also, on the call, the CEO emphasized that these are fully committed contracts with active work ongoing (sometimes companies announce a big contract, but it sits inactive; that’s not the case here). Argan expects even more backlog additions this year: management indicated that if a couple of pending projects get finalized, backlog would “get us significantly above $2 billion” later in 2025.

They did caution that timing is not entirely in their control (clients decide start dates, etc.), so backlog might “bounce around” quarter to quarter. But the trajectory is clearly up.

Segment Performance

Argan doesn’t formally break out segment profits in the press release, but the presentation gave some colour. The Power Services segment (Gemma) generated $160M of the $194M Q1 revenue (83%) and an impressive ~$31M pre-tax profit. That’s roughly a 19% pre-tax margin for Power, which aligns with the high gross margin.

The Industrial Services segment had $29M revenue (15%) and ~$2M pre-tax income, which is a solid 7% margin, though revenue was down from $44M the prior year due to project timing. Management mentioned Industrial services had a “slight contraction” as a few projects wound down, but importantly, TRC’s backlog increased to $91M, and they expect that segment’s revenue to “increase meaningfully over the next several quarters” as new projects start. In other words, Industrial may have just bottomed and should ramp up again (which makes sense with all the manufacturing projects coming).

The Telecom segment did $4M revenue (2%) and basically broke even (tiny $0.1M loss), so not much to say there, it’s stable and negligible to the whole.

Cash & Shareholder Returns

As discussed, Argan’s cash pile grew to $546M by quarter-end. The company paid a $0.375 dividend during Q1 (versus $0.30 a year ago), and it repurchased $8.4M of stock (roughly 50,000–60,000 shares). There is $114M remaining under the buyback authorization as of Apr 30. The slight uptick in shares outstanding (13.639M vs 13.634M at Jan 31) suggests that stock option exercises offset some of the Q1 repurchases. Regardless, Argan is clearly using its cash to reward shareholders, which is great to see.

Zooming out, though, it’s interesting to see the sequential shrinkage in share count over the past few years, followed by a recent uptick. Shares count dropped from ~16 M in early 2022 to ~13 M by early 2025, as AGX consistently deployed buybacks and treasury stock programs. The company has successfully reduced share count by over 20 % in just three years (2022–2025).

Plotting this trend, it’s clear that Argan executed meaningful repurchases, reducing the count from 16 M to around 13 M. The tiny increase within Q1 2026 largely reflects new share issuance tied to option vesting and plan-based grants, rather than any large share flotation.

A few more qualitative takeaways from management’s commentary are worth noting:

Argan is very optimistic about the pipeline of future projects. Watson said “we are seeing a number of opportunities” and that Argan is competing for the buildout of energy infrastructure as the industry scrambles to add capacity. He did stress they remain disciplined and focused on profitable growth (i.e. not just chasing revenue for its own sake). This discipline is comforting as it suggests they won’t bid recklessly low just to win work.

The Sandow Lakes 1.2 GW gas plant in Texas, which is now underway, is a significant project. It’s using Siemens Energy’s latest high-efficiency turbines that can eventually run on hydrogen, meaning it’s somewhat future-proof. When completed (estimated 2028), that plant will supply power to ~800,000 homes in ERCOT (Texas grid). Argan’s ability to win and execute such a huge, complex project (only a few firms can handle a 1.2 GW EPC) speaks to its credibility in the industry.

The Trumbull Energy Center (950 MW gas plant in Ohio) is nearing completion (finish in 2026). This likely means Argan will free up resources to start new big projects (like Sandow) as Trumbull winds down. Also, as Trumbull wraps up, Argan should collect final payments and release working capital tied up in that project, potentially boosting cash flow.

Argan is working on a ~700 MW gas plant in the U.S. that it got NTP on in 2024 (the details weren’t public, just called “Gas Power Project” in backlog), and a series of solar+battery projects in Illinois (three projects, two of which were completed in FY25 and the third finishing in FY26). They also have a 300 MW biofuel power plant in Ireland (Tarbert power station for SSE Thermal) that kicked off in Q1.

An interesting note: project durations are stretching out a bit, mainly due to supply chain factors. Watson mentioned that historically big gas plant projects might take 2.5–3 years, but now it’s more like 3–4 years to completion. This is primarily because certain equipment has long lead times nowadays. This means revenue from each project gets recognized over a longer period. While that might slow annual revenue growth in the short term, it also keeps backlog on the books longer (and perhaps gives more margin opportunities if managed well). It’s not a big concern, but something to keep in mind as the cadence of revenue will be a bit more drawn out for these multi-year projects.

All told, Q1 confirmed that Argan’s operational performance is excellent. The company is growing fast, earning strong margins, and locking in future business at an unprecedented rate (as seen in backlog). These results also underpin the stock’s big move as Argan is delivering the kind of numbers that justify investor enthusiasm.

If one only looked at the high P/E multiple without context, they might scratch their head, but seeing 176% EPS growth and a 2x increase in backlog provides that context: Argan is currently earning its premium valuation through execution.

Next, let’s zoom out a bit and discuss the industry outlook and macro environment that Argan operates in. This will shed more light on how sustainable this growth might be.

Industry Outlook: Infrastructure Supercycle: Why Power Demand & Investment Are Skyrocketing

If it’s not already clear, AGX is riding some powerful secular tailwinds. We are essentially at the intersection of multiple mega-trends that drive infrastructure investing, and Argan sits right at that nexus by being an energy project builder.

Modern economies are becoming ever more electrified. More devices, vehicles, and processes that used to run on combustion or analog systems are now running on electricity.

Trend #1. Data Centers & AI

Our digital lives (cloud computing, streaming, AI processing) live in giant data centers. These server farms consume enormous amounts of electricity, not only to power thousands of servers but also to cool them 24/7.

With the explosion of AI, this is accelerating. To quote Argan’s investor slide: “AI power demand is projected to grow at an annual average of 70% through 2027.” Each new AI data center might draw as much power as a small city. Companies like Microsoft (MSFT 0.00%↑), Google (GOOG 0.00%↑), Amazon (AMZN 0.00%↑) are racing to build more data centers and they can’t plug those into an aging grid without new power plants or upgrades.

That’s where EPC contractors come in. As evidence of underinvestment, a lot of existing gas power plants are 20+ years old, and many are retiring. We have a situation where, for the first time in decades, U.S. electricity demand is rising steadily (after being flatish), coinciding with a wave of plant retirements. This is a recipe for a capacity crunch unless a major investment happens.

Trend #2. Electric Vehicles

Transportation is going electric, from Teslas to e-bikes to electric school buses. As mentioned, forecasts see EVs multiplying exponentially and adding hundreds of terawatt-hours of demand to the grid in the coming decades.

If millions of cars plug in every night, we’ll need a lot more power plants (or risk brownouts). States are already mandating EV adoption and building charging corridors (e.g., the U.S. NEVI program for highway fast chargers). Every EV charger installed is essentially a new load on the system. Utilities are responding by planning new peaking power plants and infrastructure upgrades to handle EV charging surges (imagine an entire neighbourhood charging cars at 6 pm, that’s a new peak load to supply).

Argan’s capabilities in building both gas-fired plants (for reliable baseline power) and renewable/battery systems (for clean peak shaving) position it well for the EV-driven grid upgrades.

Trend #3. Reshoring & Industrial Boom

The geopolitical and economic shifts have led to a renaissance in domestic industrial projects. Billions are being poured into new factories from semiconductor fabs in Arizona and Texas (speaking of fabs in Arizona, check out my deep dive on TSMC (TSM 0.00%↑) and learn why it is my highest conviction pick), to battery gigafactories in the Midwest and South, to new steel mills, LNG terminals, you name it.

The U.S. Chamber of Commerce projected above 3% GDP growth in 2025, aided by such investments. All these industrial facilities are energy-intensive (a chip fab is extremely power-hungry, as are battery plants). They often require dedicated substations or onsite power generation for reliability. Moreover, many are being built in regions like the Southeast, where the grid may need expansion.

Argan’s TRC unit benefits here by building out the electrical and mechanical infrastructure inside and around these plants. Also, policy support like the IRA provides tax credits for clean energy usage at factories, which can lead to projects like on-site solar plus battery installations: again in Argan’s wheelhouse.

Trend #4. Underinvestment & Retirements

A critical piece is that the past decade saw underinvestment in certain energy infrastructure, especially natural gas plants. After the mid-2010s, fewer gas plants were built as the market focused on renewables. Now, renewables alone aren’t meeting around-the-clock demand, and many old coal/gas plants are being decommissioned.

For example, 12.3 GW of U.S. power generation capacity is set to retire in 2025, a 65% jump from the 7.4 GW retired in 2024.

Over the next 10 years, 78 GW of power plants are slated for retirement, that’s roughly 15-20% of U.S. capacity!

This creates an urgent need for new, reliable power sources. The industry has realized it needs to build again. Natural gas, despite being a fossil fuel, is getting renewed attention as a bridge and backup for renewables because it’s quick to build and can provide steady output.

As the CEO put it,

We continue to see growing attention around the increase in energy demand driven by the widespread electrification of virtually every sector of the economy. For the first time in decades, this rising demand is coinciding with the aging and retirement of a substantial portion of the nation's natural gas infrastructure. AI data centers, complex manufacturing operations, and EV charging all require a reliable, high-quality 24/7 power supply.

At the same time, renewable energy projects continue (solar, wind, plus battery storage) to meet decarbonization goals. So, essentially, both are needed: new gas plants and new renewables. Argan is one of the few contractors equally adept at both. Their backlog breakdown (67% gas, 28% renewables) shows they’re capturing demand on all fronts.

Trend #5. Grid & Utilities Spending

Beyond generation, the grid’s transmission and distribution infrastructure is aging and stressed. High-profile blackouts (Texas freeze, California fires, etc.) have prioritized grid reliability. While Argan doesn’t build transmission lines, the knock-on effect is utilities investing in “24/7 power” resources, e.g., on-site generation for data centers, microgrids, peaker plants near load centers.

Also, the federal infrastructure bill and IRA are funnelling money into energy projects. For instance, IRA’s tax credits make renewable projects more financially attractive (AGX can indirectly benefit as an EPC for those projects). Meanwhile, the infrastructure law had provisions for grid upgrades and resilience that could spark projects where Argan might play a role (like grid-connected battery systems or retrofitting plants).

In summary, the industry outlook for power infrastructure is extremely robust. We are in what some call a “once-in-a-generation” investment cycle for energy infrastructure. Some even liken it to an “energy arms race”: as electrification and decarbonization goals press forward, tens of billions of dollars will be spent on new capacity and system upgrades. Argan’s management certainly believes this cycle has legs. Watson stated that the current construction cycle is “still in its early stages” and that trends like reshoring, data center growth, and EV adoption “will create a wave of investment in the coming years”, from which “Argan will strongly benefit”.

Importantly, Argan’s strategy of being “energy-agnostic” (i.e., they’ll build gas, solar, biomass, whatever the client needs) is an edge. Some competitors are specialized in one area (e.g., pure renewable EPCs, or pure oil & gas). Argan can pivot to where the demand is hottest. Right now, that seems to be combined-cycle gas plants (hottest due to reliability needs) and utility-scale solar with storage (hottest due to clean energy mandates). Argan has projects in both categories. If hydrogen or SMR (small modular nuclear reactors) become a thing in a few years, Argan could likely compete for those too (Gemma’s skillset in power plant construction is broadly applicable).

Speaking of SMRs, check out my piece on The Future is Nuclear if you want to learn more about SMRs.

To illustrate the demand, consider that Argan’s backlog of $1.9B at April 2025 is comprised of multiple large projects that each address these trends: a 1.2 GW gas plant (supports grid reliability in Texas’s booming data center market), a 950 MW gas plant in Ohio (replacing older capacity in PJM region), a 405 MW solar farm in Illinois (clean energy addition), several solar+storage projects (to meet renewable portfolio standards), a 300 MW biofuel plant in Ireland (part of Europe’s transition), and even water treatment plant projects (infrastructure to support population growth in NC). It’s a diverse mix, but all threaded by the common theme of modernizing and expanding infrastructure for a more electrified world.

From an industry perspective, the wind is very much at Argan’s back. The demand is driven by deep, long-term trends that are expected to play out over the next decade or more. This underpins a multi-year growth runway. Of course, demand alone doesn’t guarantee success (execution and competition matter), but it’s a lot easier to grow when the pie is expanding rapidly. We’ve seen this in Argan’s ability to win contracts; management notes that “the energy industry is turning to a combination of natural gas and renewable resources to ensure reliability” and Argan “builds them all”, with a proven track record in both. Few companies are as well-positioned to capitalize on this infrastructure supercycle.

Now, speaking of competition, it’s important to discuss who Argan competes against and how it stacks up, especially now that it’s winning so much business. This will give us insight into whether Argan’s success is sustainable or if bigger players might eat its lunch.

Competitors and Argan’s Edge: How a Small Company Outshines the Big Players

In the world of engineering & construction (E&C), Argan is a relatively small player (market cap ~$3B, annual revenue <$1B) compared to some heavyweights.

For power plant EPC (Engineering, Procurement, Construction) projects (like large gas-fired plants or utility-scale renewables), typical competitors include:

Fluor Corporation (FLR 0.00%↑): A giant global EPC contractor. Fluor builds everything from refineries to LNG terminals and also power projects. However, Fluor has had well-documented struggles in recent years with project execution, cost overruns, and even exiting certain businesses. They’ve been less focused on U.S. power generation projects lately and more on energy/chemicals and infrastructure.

Bechtel: A private behemoth in construction. Bechtel certainly can build big power plants (and they do some). But Bechtel tends to focus on mega-projects (like nuclear plants, large infrastructure) and may be picky on smaller gas plant jobs. They also often serve as an owner’s engineer rather than EPC on power. Notably, Bechtel built a lot of renewables but got burned on some wind/solar margins.

Kiewit: A large private construction firm that is very active in power EPC (gas plants, etc.), especially in North America. Kiewit is a strong competitor on gas-fired projects; they built a number of combined-cycle plants in recent years. Argan’s Gemma often bids against Kiewit on projects of, say, 500 MW to 1,000 MW size.

Black & Veatch: Another large private engineering firm with power capabilities (often doing design and sometimes EPC for gas and renewable projects). They are more engineering-centric (design and consulting) but sometimes partner with construction firms.

Siemens Energy (Pink: SMEGF), GE (GE 0.00%↑), Mitsubishi (Pink: MSBHF) and other OEMs: Sometimes the equipment manufacturers will do EPC wrap for their power plant equipment as part of a package deal. Siemens, for instance, has a unit that can EPC a gas plant when they sell turbines (though Siemens has also struggled, as evidenced by issues in their wind division).

Renewable-focused EPCs: for solar/wind projects, there are specialized firms (like Mortenson, Blattner (acquired by Quanta (PWR 0.00%↑) ), AECOM (ACM 0.00%↑) in some cases, etc.). Argan’s competition in solar EPC might be these. However, the renewable EPC space has been tough as a lot of firms have had margin issues due to supply chain and contract terms (we saw wind turbine makers and wind farm builders suffer big losses recently).

Now, what is Argan’s edge that allows it to not just compete but thrive among these players?

Edge #1. Focus and Expertise

Argan (Gemma) has a deep specialization in power generation projects. It’s basically their DNA. Some competitors like Fluor or Bechtel do power among many other things, but they may not give it the same attention, or they take on riskier projects (like Fluor had disastrous forays into European offshore wind, etc.).

Argan sticks to what it knows, building power plants in the U.S. (and some in UK/IRE). Over the decades, Gemma built a reputation for delivering complex power projects on time and on budget. CEO Watson said on the call, “Argan is one of only a few companies that have the capabilities to successfully execute [large] combined-cycle natural gas projects, and we have a track record that validates our reputation as a proven industry partner”.

That’s a strong statement that is essentially implying that many others have stumbled on these projects, leaving just a handful of reliable contractors (Argan among them). The power EPC market did see some shakeouts as firms like Skanska quit the U.S. power EPC market after incurring losses, etc. Gemma survived and thrived by not screwing up.

Edge #2. Strong Project Execution & Margins

Many big E&C firms often suffer from “profitless prosperity”. They win huge contracts but at low margins, and any hiccup turns them into losses. I’ve seen firms like Siemens Energy (wind division) and Vestas (Pink: VWDRY) (wind turbine maker) struggle with margin pressure or even losses.

By contrast, AGX has healthy margins (as evidenced by its 15-20% gross margins, which are relatively high for EPC work). This likely stems from bidding discipline and project management skills.

Argan tends to mitigate risk on fixed-price contracts by locking in equipment prices early and carefully managing subcontractors. They mentioned in filings that for major fixed-price jobs, they procure equipment early to avoid material cost surprises. This operational excellence is an edge. Clients notice which contractors consistently deliver vs. those constantly dealing with change orders and delays.

Edge #3. Financial Stability (No Debt)

I’ve discussed the balance sheet, but from a client’s perspective, hiring a contractor with no debt and huge cash is a plus. It means Argan can provide required performance bonds easily (some peers might be near bonding capacity limit), and there’s a low risk of AGX itself running into financial distress mid-project.

Clients burned by past EPC failures (e.g., when Westinghouse went bankrupt during nuclear projects or when smaller contractors default) are likely to trust Argan more, knowing it’s financially solid.

Also, Argan can afford to turn down bad business. Larger public firms sometimes chase revenue to satisfy Wall Street and end up with bad projects. Argan, with its cash cushion, can be more selective. As I noted, they’re reluctant to enter fixed-price contracts with high-risk profiles … that prudence pays off.

Edge #4. Size and Overhead

Here, Argan’s small size is an advantage in some cases. Big conglomerates have layers of bureaucracy and high SG&A costs. Argan’s entire corporate structure is lean (just ~1,400 employees, including craft labour). Their SG&A is running ~6% of revenue, which is pretty low.

This means Argan can often bid more competitively yet still make money, because it doesn’t have to feed a huge corporate beast. Meanwhile, a Bechtel or Fluor might have higher overhead allocations on a project. Also, being smaller, Argan can give clients more attention from top management. A $500M project is a big deal for Argan (they’ll treat it with utmost importance), whereas for Fluor it might be just another project among dozens.

Edge #5. Niche Dominance & Relationships

Argan’s Gemma Power likely has strong relationships with certain independent power producers and utilities from past jobs. Repeat business is common in this industry if you perform well.

For example, Gemma built multiple projects for Competitive Power Ventures (CPV) in the past. Those relationships can lead to negotiating advantages or at least inclusion in bid lists where newcomers might not be invited. Argan also sometimes partners with others, e.g., for international work or specialized components, but they usually prime the contract.

Edge #6. Competitors’ Weaknesses

It’s illuminating to see what competitors themselves are facing:

Fluor has been trying to restore profitability; they likely price more conservatively now and might avoid certain power jobs after past troubles.

Bechtel and Kiewit are formidable, but they have plenty on their plate (like LNG terminals, infrastructure projects) and may not undercut pricing just to get more gas plant work. They also might have limits on how many projects they can handle at once. The fact that Argan won Sandow Lakes (1.2 GW) suggests it outcompeted some big names, possibly because AGX had a cost advantage or the client trusted Gemma’s track record specifically.

Renewable EPCs like Mortenson have struggled with cost inflation and labour issues, leading some developers to seek alternatives (some solar developers even bring EPC in-house due to dissatisfaction). Argan’s renewables work, while a smaller portion, benefits from its project management rigour developed in gas projects, perhaps yielding fewer issues.

Edge #7. Breadth of Capabilities

As mentioned, Argan can handle multi-disciplinary projects. A firm like Vestas (turbine supplier) or Siemens Gamesa might handle a wind farm end-to-end, but they typically don’t do gas plants. On the flip side, a conventional contractor might not have experience with battery storage integration. Argan doing both gas and battery/solar means that if a client wants a hybrid solution (e.g., a gas plant plus a battery system for frequency regulation), Argan can do it.

A great example: Argan’s current Texas project uses gas turbines that are hydrogen-capable, bridging traditional and future tech. Argan can market itself as “energy transition ready” while still delivering conventional power. Some competitors either tout energy transition but lack heavy EPC experience, or vice versa.

Of course, competition isn’t static. If the market stays hot, big players will refocus on power projects, and new entrants could emerge (for example, some international EPCs might eye the U.S. market). But for now, Argan’s position looks strong. They’ve won multiple marquee projects recently (often, one could expect Bechtel/Kiewit to win those). As long as Argan keeps executing well, it should continue to win its fair share or more. Also, I wouldn’t rule out Argan being an acquisition target itself for a larger player wanting to bolster power EPC capability, though given its strong performance, it would command a premium (pure speculation on my part).

One point to acknowledge: Argan’s size does limit how many projects it can handle simultaneously. There is only so much a ~1,400-person organization can take on without strain. On the call, an analyst asked if there’s an optimal backlog level given finite capacity. Watson responded that backlog could bounce as they add big jobs and burn off others, but they expect it to rise overall, and they’re excited about opportunities beyond the near term, implying they believe they can handle growth.

Argan invested in expanding its teams and workforce last year in anticipation of the workload ramp-up, so they’ve been proactive. Still, it’s a factor: if backlog goes to +$3B, Argan might need to scale up significantly or sub-contract more, whereas a Bechtel could maybe absorb more. I consider this a high-class “risk”: growing pains if growth is too rapid.

Let’s now get into the numbers. How do I value AGX after this big run, and what’s changed since my original $278/share DCF target?

DCF Valuation: Raising My Fair Value from $278 to $290

Back in December, I valued Argan using a DCF model and arrived at a fair value of about $278 per share, roughly double the stock price then. Now that the stock has surged and the company’s fundamentals have evolved, it’s time to update that valuation.

I’m raising my DCF-based fair value to $290 per share. That’s not a huge jump (+5%) from the prior $278, but it does suggest that even after the stock’s big run, there is still upside (32% upside from the current ~$220 level) if Argan meets the updated expectations. Let me walk you through the changes in assumptions behind this new target and tie them to the facts we’ve discussed:

Revision #1. Revenue Growth Expectations (Upwards Revision)

The first and most obvious update: Argan’s revenue forecast for the next few years is higher now, thanks to the record backlog. In my original model, I had assumed a robust growth trajectory, but the reality has outpaced it.

For instance, I initially expected FY2025 revenue to grow around ~46%, but in fact it grew ~53%. Now, after Q1 and with $1.9B backlog, I believe FY2026 could see 11% revenue growth. Please note that while revenue growth is lower percentage-wise from my previous valuation, it is higher on an absolute basis as the base is higher.

Management has effectively guided that revenue will ramp up as new projects (like Sandow) move from the early stage to full activity over the year. I’ve extended strong growth a bit further out with such a backlog; FY2027 should also be up nicely. Specifically, my new model projects revenue roughly doubling over the next 4-5 years (crossing $1.9B by FY2030) before growth tapers to mid-teens and then high single digits by the end of the decade.

Previously, I might have been a bit more conservative in the out-years. This is justified by the secular drivers we discussed. The pipeline of projects likely won’t dry up after the current backlog; if anything, AGX could keep adding new ones as older projects finish. For example, the CEO noted they expect to “continue to add to the backlog” even as they execute, because the market opportunities extend into the long term.

To anchor these assumptions, Argan’s backlog of $1.86B guarantees at least ~$1.3-1.5B of revenue over the next couple of years (spread over project durations). The company did $874M in FY25. So doing, say, $1.0B in FY26 and $1.2B in FY27 is very plausible (that’d be ~11% and ~20% growth, respectively). I suspect they might exceed that if they win more projects.

Revision #2. Profit Margins (Increased Assumptions)

Another big change: Argan’s profitability has proven better than I assumed. In the old model, I anticipated margins would improve modestly (gross margin gradually converging to ~18% and operating margins around low double-digits as fixed costs get leveraged).

Now we have evidence that gross margin can reach ~19-20% (as in Q4 and Q1), and management believes they can sustain higher margins due to a richer project mix and cost focus. So I’ve bumped up the margin profile in the DCF. I now model gross margins trending in the high teens for the next few years, but converging to the same 18% gross margin as I modelled before…but faster.

Likewise, I assume SG&A will remain around 6% of revenue (scaling with growth) down from 6.5% in my previous model. These changes boost EBITDA margin by 100-200 bps. This change is supported by the facts: Argan’s last twelve months EBITDA margin is ~14%, and that’s including some early-phase projects that had lower margins; going forward, we could see +15% sustained given the strong start this year. Higher margins directly boost future free cash flows in the DCF.

One might ask, is it safe to count on ~18% gross margins long-term? There is some risk (EPC can be lumpy), but Argan’s strategy of focusing on higher margin projects (e.g., they hinted they are shifting project mix toward those with higher margins in backlog ) gives confidence. Also, their strong execution track record means less likelihood of nasty surprises that wreck margins (knock on wood).

Revision #3. Interest Income & Cash: Don’t Forget the “hidden” boost

A subtle factor: interest rates are higher now than a year ago, and Argan’s big cash pile generates a nice chunk of interest income (which flows into net income and cash flow).

My original model did factor in some interest income (they had ~$10M in FY25). I’ve updated it to reflect the current reality: Argan has $546M in cash, earning perhaps ~5% short-term yield; even after dividends and buybacks, they’ll likely keep +$500M cash for a while (they don’t need to spend it all).

So we could see ~$20-25M in annual interest income near-term, assuming rates stay relatively elevated. Indeed, in Q1 Argan earned $5.5M in interest and dividend income (not explicitly broken out in the press release, but we can infer from net income vs operating profit).

Over time, I do assume rates normalize down (and Argan might eventually deploy cash), so I don’t model that to grow forever. But near-term cash flows are higher thanks to interest. This is partly why Argan’s net income is outpacing operating income growth recently. In DCF, more cash in the early years and a higher cash baseline help valuation.

Revision #4. Capital Allocation: Impact of Buybacks and Dividends

Argan’s capital returns don’t directly change enterprise value, but they do affect the per-share value. Since December, Argan has repurchased some shares and will likely continue to do so. Fewer shares mean higher value per share for a given equity value.

My original model had a share count of ~15 million (perhaps not assuming significant buybacks). Now the share count is ~13.64 million and headed lower.

I factor in the buybacks by essentially valuing the equity after those cash outflows. The expanded $150M buyback, if executed, would reduce shares by ~500k - 800k (depending on prices paid). So I adjust the share count down in the model’s future years, or two.

Similarly, dividends paid don’t reduce per-share value since every shareholder gets the cash, but it does use up some cash that could otherwise sit on the balance sheet. However, Argan’s free cash flow covers the dividend easily (and then some), so it’s not constraining growth.

Revision #5. Risk Profile: Discount Rate and Other Assumptions

One thing I did not significantly change is the discount rate (WACC). In the original analysis, I used a 7.1% discount rate, based on an unlevered beta for the industry of around 0.8 and assuming Argan might eventually employ some debt (35% debt-to-capital).

Argan still has no debt; I’ll keep assuming a moderate target capital structure in the long run (they could decide to take on project debt or optimize WACC at some point, but nothing imminent).

Even if I leave WACC ~7%, the slight change in interest rates or equity risk premium since late 2024 is not enough to move the needle much. One could argue Argan is a tad less risky now that it has a larger backlog and proven momentum (so maybe a slightly lower equity risk premium). I’ll stick with roughly the same discount rate. So the increase in fair value isn’t due to a lower discount; it’s due to higher projected cash flows.

I also continue to use a fairly conservative terminal growth rate (2% in perpetuity). You could justify a bit higher if you believe Argan will still be growing in 15 years, given the secular trends, but I’d rather be cautious.

Now, putting it together: The result of these updated inputs is that my DCF model spits out a value per share of $290. This suggests that, despite the stock rallying +87%, Argan’s intrinsic value has also increased, keeping some upside in play. In effect, the company’s exceptional performance filled in a lot of the valuation gap. Keep in mind that the $290 valuation is pretty conservative as detailed above, especially on the revenues and margins, where I believe there could be more upside.

One should note that DCF is sensitive. If margins slip or projects get delayed, the fair value would drop. On the other hand, if Argan wins even more projects and extends its growth runway, the fair value could be higher. For instance, in a bull case scenario (revenues growing into the multi-billions by early 2030s and margins staying high), I can see a case for +$360 per share. Conversely, in a bear scenario (growth stalls after current backlog, or a major project loss hits margins), the fair value might be closer to $180.

It’s also worth remembering that DCF, while a rigorous method, is still just a model. We must monitor real-world developments. Given Argan’s execution so far, I’m comfortable that the risk of downside to cash flow is moderated (they have backlog in hand to produce a lot of earnings). The bigger unknown is what happens after this backlog; will there be a cliff or a smooth continuation? I leaned toward a smooth continuation due to industry trends.

I want to emphasize, though, Argan’s valuation now carries higher expectations. The DCF says $290 is fair if Argan hits these assumptions. If Argan were to miss earnings or if new awards slowed unexpectedly, the stock could easily correct. The current ~33x forward P/E means the market is essentially anticipating the growth we’ve discussed. My model aligns with that optimism. As management themselves warned, “the current valuation is only justified if the company continues to deliver above-expectation results”, a miss could cause a notable drop .

So while I see upside to ~$290 (and thus I’m still bullish), I’m cognizant that the margin for error is thinner now than when it was $120. That’s also why I’ve slightly trimmed my position, not because I’m any less confident in the long-term thesis, but because at this price, the setup requires near-flawless execution. I’d rather take some profits here and redeploy into ideas with a more asymmetric risk-reward at this stage. This is where risk management and monitoring come in, which leads nicely into the next sections on insider activity and risks.

Now let’s address something that’s been on many investors’ minds: the insider selling spree we’ve witnessed as the stock climbed.

Insider Selling: Lots of Execs Cashing Out, A Warning Sign or Business as Usual?

A striking development over the past year has been the significant insider selling of AGX stock. Whenever I see heavy insider sales, I pay attention. Insiders can sell for many reasons (taxes, diversification, etc.), but when almost all insider transactions are sales and in large quantities, it’s worth examining. In Argan’s case, virtually every major officer and director has sold shares in the past 12 months, some of them rather aggressively.

According to filings (see the image above), insiders have sold approximately $50 million worth of AGX stock in the last 12 months, with no buys. Some notable instances:

CEO David Watson has been a seller multiple times. In July 2024, he sold ~15,000 shares at ~$77.79. Then on Dec 18, 2024 (just a week before my initial article was published), he sold 10,000 shares at $146. More recently, on June 9-11, 2025, Watson sold ~20k shares for around $211-$230. Those are large chunks, which represented a big portion of his holdings (though he still retains shares).

Chairman Rainer Bosselmann (who is Argan’s former long-time CEO and a significant shareholder historically) has also sold heavily. For example, in June/July 2024, Bosselmann sold ~100k shares at $69-$77. He continued selling in smaller blocks through late 2024 (5k here, 10k there). Then on June 11, 2025, he sold ~14k shares at $221.58. In total, Bosselmann’s sales are in the millions of dollars as well.

Other Directors and Execs: We see numerous others: James Quinn (Director) sold ~20k shares in Sept 2024, around $88-89 and another 40k at $207 in June 2025. Cynthia Flanders (Director) sold 5k at ~$96 in Sept 2024. William Griffin Jr. (Director) sold a flurry of shares in mid-2024 (over 47k shares, around $77-90). Peter Getsinger (Director) sold ~7k at $145-$155 in Apr 2025 and more earlier at $78-165.

In total, 41 insider sale transactions are listed over the past year, with not a single insider purchase. The sales spanned share prices from the $70s up to $230+. The fact that insiders kept selling as the stock rose (rather than stopping at, say, $150) indicates they were likely following predetermined selling plans or simply taking incremental profits on the way up.

So, what do we make of this? On the one hand, insider selling often raises a yellow flag. Insiders might sell because they think the stock is fully valued or because they don’t expect further huge upside. It can also sometimes presage issues (insiders selling ahead of bad news).

On the other hand, insiders are human. After a stock doubles or triples, it’s natural for them to take some money off the table for diversification or personal liquidity. Many of these individuals have had a lot of their net worth tied to Argan for years (Bosselmann, for example, founded Argan decades ago). The company also had a stock option program (we saw options being exercised at ~$45 and withheld for taxes at ~$80 in the 10-K). Some sales might be related to options being cashed in.

A few interpretations:

Profit-Taking After Big Run: The simplest explanation is that insiders saw the stock price shooting up and decided it’s a prudent time to sell some. For instance, CEO Watson selling ~75k shares at $136 in Dec 2024 might have been him saying, “our stock doubled (from ~$70 earlier in 2024), I’ll lock in some gains.” Then the stock kept going to $230, and he sold another chunk. This doesn’t necessarily mean Argan is a bad investment going forward; it might mean Watson is amazed (as we are) at how fast the price appreciated and is opportunistically trimming. It’s worth noting Watson still has shares; he didn’t exit completely. But yes, he’s significantly reduced his stake to 0.5% of the company.

Valuation Concerns: It’s possible insiders felt the stock price was getting ahead of itself at various points. For example, multiple directors sold in the high $70s in mid-2024, maybe thinking it was fairly valued then. Then, as it kept rising, they kept selling. We don’t know their internal thought, but insiders often have an intrinsic value in mind. The fact that none of them are buying at these levels suggests they don’t view it as undervalued anymore, at least. Insiders are usually reluctant to buy when the stock has already run a lot (and they might be in blackout periods anyway). But the absence of buying while there’s heavy selling does indicate a one-way sentiment among them.

Pre-set 10b5-1 Plans: Some of these sales could be under pre-arranged trading plans, where insiders schedule sales in advance (for example, to systematically sell X shares each quarter). The data doesn’t specify that, but often, large planned sales are executed incrementally. The pattern of Bosselmann and others selling in chunks over time could align with planned selling. If so, it’s less about short-term opinion and more about personal financial planning.

Insider Ownership Levels: After all this selling, insiders (execs and directors) still hold some shares, but fewer. For instance, Bosselmann and Watson still each hold 211k and 69k shares respectively (see table below). But clearly, they wanted liquidity. Some insiders may be nearing retirement or just diversifying, e.g., Rainer Bosselmann is in his 80s now; it’s natural for him to reduce his stake for estate planning.

What does this mean for us? It’s a note of caution, but not necessarily a deal-breaker. Insiders selling heavily around current prices suggests they might feel the stock’s risk/reward is more balanced now. They could also simply be enjoying the fruits of their labour, which is understandable (imagine being an insider who held through years of stock stagnation and now seeing a huge payday).

One might recall that insiders aren’t infallible market timers. There are cases where insiders sold a lot and stocks kept going up (and vice versa). However, it’s generally a mildly negative signal. In Argan’s case, insiders have been selling since the $70s, so if you followed their initial lead, you would’ve missed a lot of upside. Now they’re selling at $200+, which could mean upside is more limited from here (or it could mean they’ll miss further upside if it goes to $290, time will tell).

It’s also important to note that the fundamentals don’t show any red flags that insiders are bailing on a sinking ship. Quite the opposite as the business is booming. If insiders were selling as results deteriorated, I’d be very concerned. Here, they’re selling into strength. Often, insiders do that when they see a window of very positive news (like backlog at record, earnings great) and think it’s prudent to trim before any possible hiccups. One could cynically say, “insiders think this is as good as it gets for now”. Or pragmatically: “Insiders have most of their performance stock vested and want to enjoy the gains”.

I take the insider selling as a reminder to remain vigilant. It suggests that even those closest to the company consider the stock fairly valued (or at least not undervalued) around current levels.

But I don’t interpret it as them lacking confidence in Argan’s future. Instead, CEO Watson on the call was upbeat about long-term growth, and one director even commented how the stock still had a strong year ahead.

Risks and What Could Go Wrong

No investment is without risks, and despite Argan’s many strengths, there are several risk factors we should keep in mind. I touched on some earlier, but let’s consolidate the key risks:

Risk #1. Project Execution & Fixed-Price Contract Risk

This is perennial in the construction industry. Argan often enters fixed-price EPC contracts, meaning if they underestimate costs or hit unexpected issues, their profit can vanish or turn into a loss.

Risks like soaring labour or material costs, supply chain delays, or low labour productivity can erode margins. For instance, if steel prices spiked or a critical turbine delivery was delayed, Argan might incur extra costs or penalties.

While Argan has managed this well so far (and even locks in a lot of costs upfront), one cannot rule out a problematic project. A single large loss-making project could dent earnings and investor confidence.

Argan’s strategy is to be selective and include contingencies, but risk is inherent. I’d monitor projects like the 1.2 GW Sandow closely as that’s a big, multi-year contract; any major hiccup there would be felt.

Risk #2. Economic Cyclicality and Demand Risk

While we are in a good cycle now, the construction business is cyclical. A recession or an industrial downturn could cause clients to delay or cancel projects. Argan is somewhat insulated in that many projects are driven by structural needs (like replacing retiring plants), but an economic slump could slow down things like new factory builds or data center expansions.

The backlog helps buffer near-term revenue, but beyond that, a recession could lead to a dry spell in new awards. Additionally, Argan’s revenue can be uneven quarter to quarter depending on project timing, which could spook investors if they see a lumpy quarter (even if it’s just timing). Any significant reduction in capital spending by utilities or IPPs due to market conditions would be a risk.

Risk #3. Project Cancellations/Backlog Realization

As excited as we are about the $1.9B backlog, it’s not guaranteed revenue as projects can be cancelled or scaled down. Customers usually have the right to terminate contracts for convenience (with some compensation to Argan for work done). If, say, market conditions change or a project’s financing falls through, Argan could lose future work.

An example: If a power plant in backlog is tied to a specific need (like capacity market auction results) and those conditions change, the project might get shelved. Given current trends, most backlog projects seem solid, but this is a risk to watch. Even a delay (not cancellation) can push out revenue (and cash flow) timing.

Risk #4. Competition & Margin Pressure

While Argan currently enjoys strong margins, competition could heat up and pressure pricing. If more competitors chase the same projects, Argan might have to bid more aggressively, which could compress margins.

Large players who sat out may re-enter if they see the lucrative environment. Also, new entrants (maybe international firms or consortiums) could try to underbid to gain a foothold.

If Argan wants to maintain volume, it may accept slightly lower margins on new projects. Additionally, some clients might try to pass more risk to contractors in contracts (especially after seeing contractors do well), for example, less price escalation protection. Argan will need to balance winning work vs. maintaining margin discipline.

Risk #5. Resource Constraints

Argan’s growth is predicated on being able to execute more projects. Labour availability is a potential bottleneck. The construction industry has faced skilled labour shortages in various regions. Argan needs quality engineers, project managers, and craft labour (welders, electricians, etc.) for its projects. If they can’t staff up sufficiently, they might have to turn down work or risk schedule slips.

They expanded the workforce to prepare for the backlog, but that’s an ongoing challenge. Also, supply chain: big projects require heavy equipment (turbines, transformers, etc.), which currently have long lead times. Any disruption in the supply chain (e.g., a key supplier having issues or shipping delays) could impact Argan’s schedules and costs.

Risk #6. Regulatory and Political Risk

The fortunes of infrastructure companies can be tied to policy. Right now, policies are favourable (IRA incentives, etc.). But changes could occur.

For example, if a new administration rolled back clean energy support or if interest rates rise further, making project financing tougher, it could slow down new project development.

On the flip side, one specific risk: environmental regulations or public opposition could delay fossil fuel projects. A natural gas plant might face permit challenges or lawsuits from environmental groups, delaying NTP or execution.

Also, the reliance on natural gas projects means Argan is somewhat exposed to attitudes toward gas. If gas falls out of favour faster due to climate policy, the pipeline of gas projects could shrink (though, near-term, that risk seems low as gas is needed for grid reliability). Additionally, Argan does some work in the UK/Ireland. Currency or Brexit-type issues are minor factors but worth noting.

Risk #7. Commodity and Energy Prices

Ironically, if natural gas prices skyrocket, it might reduce demand for gas-fired plants (because utilities might pivot back to coal or delay adding gas capacity).

Right now, gas prices are moderate, but energy markets can swing. Conversely, if renewable costs plummet further, maybe gas plants become less competitive in some regions (though reliability needs are still there).

Material costs (steel, copper) also affect Argan’s project costs, though they usually pass those on or lock them in, but extreme volatility could hurt if not fully hedged.

In weighing these risks, I’d say the most immediate and tangible is project execution/cost risk. All it takes is one problematic fixed-price contract to hit earnings hard. Argan mitigates this by contingencies and experience, but no contractor is immune (e.g., even the best can hit a surprise like a subcontractor default or extreme weather causing extra costs).

The good news is Argan has significant buffers: a strong balance sheet (cash to absorb shocks), a diversified project mix, and a demonstrated conservative approach. They also often structure contracts to have some cost pass-through or at least to start with solid contingencies. And by focusing on known types of projects (no experimental designs), they reduce technical risk.

I think the riskiest scenario would be: Argan takes on too many projects too fast and quality slips, resulting in a big cost overrun and the cycle turns such that new backlog dries up, just as insiders foresaw and sold at the top. That’s a doom scenario (not base case). More moderately, even a single quarter earnings miss (say a project got delayed so revenue pushes out) could whack the stock, given high expectations. We should be prepared for volatility as this isn’t a smooth SaaS company; it’s project-driven.

Finally, valuation risk itself is a risk: with the stock at ~33x earnings, any perceived crack in the growth story could lead to a sharp re-rating (the stock could fall quickly to a lower multiple). High-growth infrastructure stocks can be unforgiving if growth even pauses. So one must be comfortable with the notion that short-term stock price could swing if, e.g., next quarter revenue is flat or backlog doesn’t rise for a period.

Final Thoughts: Still Constructive on Argan but Reducing Exposure

We’ve covered a lot of ground in this deep dive from Argan’s business basics to its latest stellar results, the industry’s growth tailwinds, competitive positioning, valuation updates, insider selling, and risks. Let me wrap up by summing up the thesis as it stands today and my stance:

Argan has executed phenomenally on the vision I laid out in late 2024. The company is firing on all cylinders: revenue is surging, profits are way up, and backlog has ballooned to record levels, validating that it’s at the heart of an infrastructure boom. In a sense, 2025 (so far) has been Argan’s “coming out party”: a relatively under-appreciated company proving its mettle and gaining recognition (as evidenced by the stock’s triple-digit rise and more media coverage now). This is a company with decades of experience that was in the right place at the right time and had the right execution to capitalize on it.