Why I Just Closed My Third Coast Bancshares (TCBX) Position: Slowing Growth, No Catalyst, Better Opportunities

A deep dive into Third Coast Bancshares (NASDAQ: TCBX), why I was bullish, and why I’ve moved on — plus what I’m buying instead.

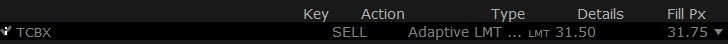

Trade Alert:

Close TCBX

I'm closing out my position in Third Coast Bancshares (NASDAQ: TCBX 0.00%↑) at around $31.75, a bit below my $33.10 entry price.

That’s roughly a 4% drop — not exactly a portfolio crusher, especially for a 0.7% position, but no one likes paper cuts in their stock investing journey.

There's no need to keep reading, but if you are curious, I'll explain why I'm making this move. Spoiler: it’s not because the bank is doomed (far from it). Rather, it’s about shifting my capital to where I see better near-term upside (eg. yesterday I sent a trade alert for a 4x-9x multibagger). Sometimes, the hardest part of stock investing is knowing when to hold 'em and when to fold 'em, and for TCBX, I'm choosing to fold (for now).

Table of Contents:

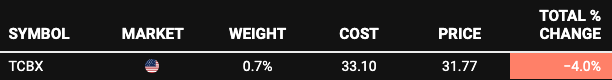

Banking in Texas: Understanding TCBX’s Business Model

Third Coast Bancshares is a bank holding company based in Texas, operating as a community-commercial bank in some of the state’s hottest markets. As of the end of 2024, TCBX had 19 branches sprinkled across the largest and fastest-growing parts of Texas — think Austin, Dallas-Fort Worth, Greater Houston, and more. In these booming regions (for example, Austin’s population is forecast to grow by 13.55% through 2028, the fastest among large U.S. metros), Third Coast serves local entrepreneurs, small-to-medium businesses, and professionals with a full menu of banking services.

In practice, that means they take in deposits and make loans, the bread and butter of any bank, but TCBX focuses especially on commercial lending. They offer everything from real estate loans and equipment financing to working capital lines, and they’ve been leaning into SBA loans lately. Of course, they also do the standard stuff like mortgages and consumer loans, but the core business model is “local bank fuels local business”.

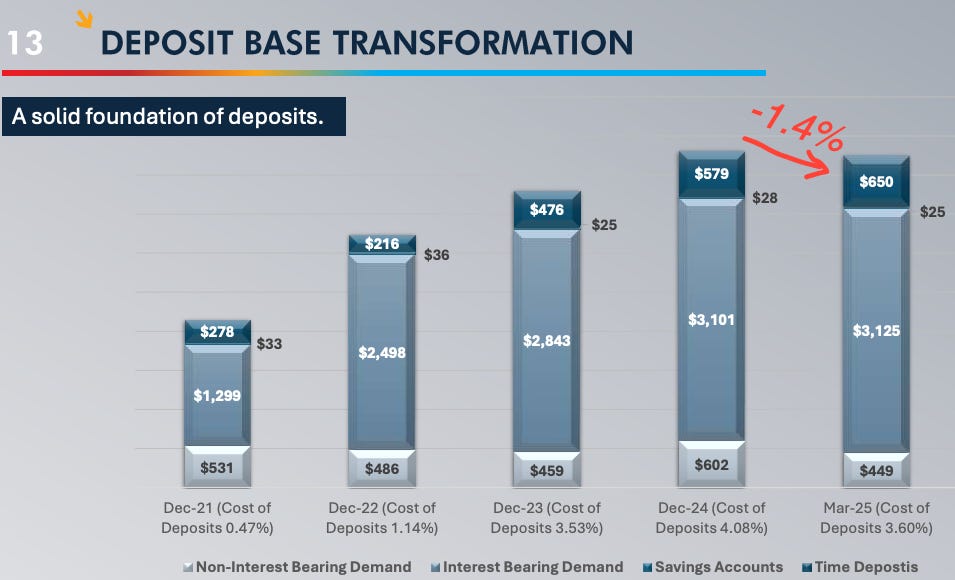

Operating in Texas has been a blessing for growth. The state’s economy (and population) has been expanding like a weed after a spring rain. Third Coast’s financials reflect that regional boom: over 2022–2024, the bank’s deposits swelled from about $3.24 billion to $4.31 billion, a 33% jump in two years. You need deposits to fund loans, and TCBX’s surging deposit base enabled a rapid rise in lending.

Importantly, they've managed this growth without sacrificing credit quality. By all accounts, asset quality has remained solid. In the most recent quarter, nonperforming assets were just 0.56% of total assets, which is quite low. In other words, only a tiny sliver of loans are giving them headaches — a good sign that they aren’t growing by recklessly lending to shaky borrowers.

Like any bank, TCBX makes money on the spread between what it pays for funds (deposits, borrowings) and what it earns on loans and investments. This net interest margin (NIM) is crucial. With interest rates rising over the past year, many banks have felt margin pressure (deposit costs go up, and if you’re not careful, profits get squeezed).

TCBX, however, actually improved its NIM to 3.80% in Q1 2025, up 9 basis points from the prior quarter. Part of this came from strategic moves like securitizing loans (more on that shortly) and carefully managing funding costs. A margin near 3.8% is healthy for a community bank, especially in today’s competitive deposit market.

So, in a nutshell, Third Coast Bancshares is a fast-growing Texas bank, serving high-growth markets with a focus on business lending. It had a great run of growth, solid loan book quality, and respectable profitability metrics. Sounds pretty good, right? It is — which is why I bought the stock in the first place.

Why I Bought TCBX: The Original Bullish Thesis (Recap)

When I first added TCBX to my portfolio, I was bullish for several key reasons:

Reason #1. Texas-Sized Growth Potential

TCBX operates in economically vibrant Texas hubs. Rapid population and business growth in Austin, Houston, DFW, etc., gave TCBX a long runway to expand. I was willing to pay a premium for this growth in markets growing well above national averages. The stock had nearly doubled (up ~95% in the year before my purchase from ~$17/share) and was no longer “cheap,” but I felt that exceptional regional growth justified the buy.

Reason #2. Strong Asset Quality

Despite its rapid loan growth, TCBX maintained commendable credit quality. Nonperforming loans and net charge-offs have stayed very low — in Q1 2025, nonperforming assets were only 0.56% of assets and quarterly net charge-offs were a trivial $398k (basically rounding error on a ~$4 billion loan book). A growing bank that’s not blowing up its credit portfolio? Yes please. This solid asset quality gave me confidence that TCBX’s growth was disciplined and sustainable.

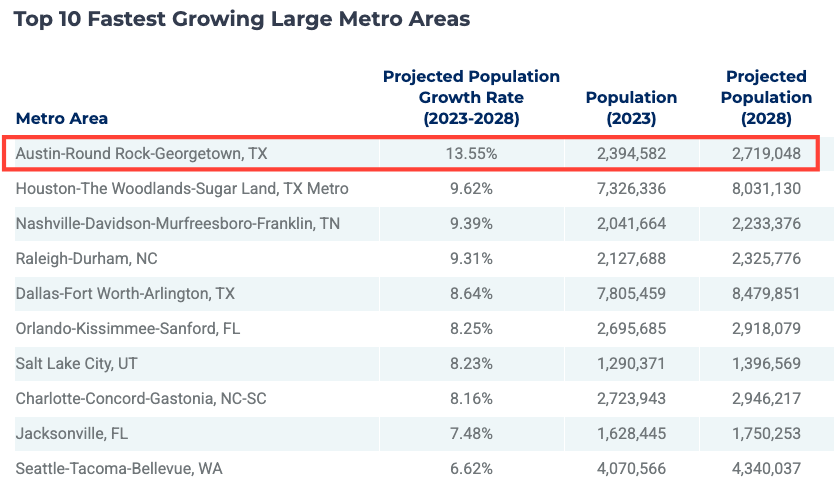

Reason #3. Book Value & Earnings Momentum

The bank was consistently beefing up its book value and earnings. TCBX’s tangible book value per share has been steadily climbing each quarter (Q1 2025 alone saw tangible book jump ~4.7% q/q).

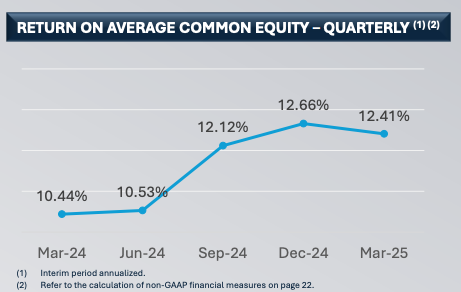

Earnings were also on a strong uptrend — for example, Q1 2025 net income was $12.4 million, up 35% y/y. ROE hit a solid 12.4%.

This showed me a bank firing on all cylinders: loan growth + widening margins + controlled costs = improving profitability. Exactly what I like to see.

Reason #4. Ambitious Growth Plans

Management wasn’t content to rest on its laurels. They have been proactively managing the balance sheet to keep growth on track. A case in point: early in Q2 2025, TCBX completed a $200 million commercial real estate loan securitization (selling a chunk of loans as securities) to free up capital and manage risk. CEO Bart Caraway noted this will add some fee income and bump NIM by ~5 bps going forward. Moves like that told me management is playing offence — finding ways to support further loan growth (they even guided to ~$325M in loan growth for 2025, about +8% YoY). In short, they’re thinking ahead.

Put together, my bull thesis was that TCBX was a quality bank riding a Texas growth wave, with good stewardship and improving financial metrics. At the time, I felt the upside from growth and efficient execution would outweigh the slightly rich valuation. It was a classic case of investing in a strong business with a long growth runway.

Q1 2025 Deep Dive: Solid Results (On the Surface)

Now let’s talk about the latest quarter, Q1 2025, which I just combed through (so you don’t have to).

At first blush, Q1 2025 was pretty strong. Earnings grew nicely y/y, NIM expanded, and ROE north of 12% is admirable for a regional bank. Not many banks are posting double-digit profit growth in this environment, so TCBX’s +35% y/y net income stands out. Much of that improvement came from higher net interest income (+12% y/y) and lower credit loss provisions, while keeping costs in check (expenses were up only 8% y/y, which is modest given all the growth).

The bank’s profitability metrics in Q1 2025 were solid. A 1.17% ROA and 12.4% ROE mean they’re deploying assets and equity effectively. For context, many community banks strive for ~1% ROA and ~10% ROE, so TCBX is clearing that bar. The 3.80% NIM is especially impressive in a quarter when a lot of banks saw margins flatten or compress. Management’s maneuver to securitize some loans likely helped buffer the margin (and more help is coming: that Q2 securitization should add a few basis points of NIM next quarter).

Asset quality remains a non-issue: nonperforming assets actually declined again in Q1, improving to just 0.56% of assets. They had a small net recovery on loans (recovering slightly more than they charged off — basically, they un-lost a bit of money). This is all to say: the credit side of the house is squeaky clean.

One more thing before we dive into what changed...

If you’ve worked with me or followed Beating the Tide for a while, you know I’m big on efficiency—streamlining workflows, cutting the fluff, and focusing on what moves the needle.

So when I went hunting for a better way to track all my portfolios in one place, I stumbled on a platform that surprisingly ticked a lot of boxes: Stock Unlock.

It’s not just a portfolio tracker. It surfaces insights, flags relevant alerts, and comes with some handy built-in research tools. Want to see insider transactions? Done. Need a DCF calculator for a quick valuation gut check? That’s in there too.

I liked it enough to become an affiliate (and yes, I’ve already sent their dev team a wish list). It’s free to try, but if you want to unlock the full thing, use my link to get 10% off your first year.

I will be using Stock Unlock to support my work and showcase the full power of the platform.

Back to TCBX…

Q1 is where the narrative shifts. When you peek under the hood, you see some yellow flags about growth and momentum. Despite the rosy year-over-year comparisons, on a quarter-to-quarter basis, the story isn’t as upbeat.

Flag #1. Flat Sequential Earnings

Q1’s $12.4M net income was essentially flat from Q4 2024. Profit didn’t grow quarter-over-quarter, which signals that the earnings momentum has stalled for now. The ROA and ROE were roughly unchanged from late 2024 levels. So while year-over-year looks great, the more recent trend is levelling off.

Flag #2. Shrinking Deposits

Deposits fell by $62 million in Q1, dropping to $4.25B from $4.31B at year-end. A ~1.4% dip might not sound alarming (some of it could be seasonal outflows or a big client using funds), but it’s a stark contrast to the rapid deposit growth of prior years. It suggests that TCBX isn’t currently gathering new deposits at the same breakneck pace — or worse, they could be losing some high-cost deposits intentionally to protect margin. Fewer deposits can mean constraint on future loan growth unless they find other funding. Indeed, with loans at ~$3.99B and deposits $4.25B, the loan-to-deposit ratio is now ~94%. That’s on the higher side, meaning nearly all deposit funding is already lent out.

Flag #3. Loan Growth Slowing

Management’s guidance for 2025 loan growth is about $325 million (8% for the year). 8% is decent, but let’s be real — it’s not the red-hot +20% growth TCBX was delivering when it was smaller. They’ve achieved ~$50M of new loans in April already, so they’re on track, but the trajectory is more moderate now. Part of this is by design (the bank is bigger, percentages naturally slow), and part might be market conditions (higher interest rates cooling demand).

The bottom line: the hyper-growth phase is likely over. We’re looking at mid-single-digit to high-single-digit loan growth going forward, barring a major acquisition or expansion.

Flag #4. Stagnant NII and NIM Outlook

Net interest income was slightly down sequentially in Q1. Why? The bank’s interest-earning assets shrank a touch (fewer loans/securities) due to that deposit drop. So even though NIM per dollar improved, the total dollars of NII fell quarter-over-quarter. Looking ahead, with the Fed likely pausing rate hikes, TCBX might not get much further NIM expansion beyond the extra ~0.05% coming from the securitization. Meanwhile, if they want to reaccelerate loan growth, they may have to raise more costly funding (either entice new deposits with higher rates or tap wholesale markets), which could pinch future margins. In other words, the easy money from rising rates has been made; from here, NIM gains will be harder and could even reverse when rates eventually decline.

Flag #5. Rising Expenses (Moderately)

Noninterest expense in Q1 2025 was up about $878k from Q4 (a 3.2% increase). The bank has been adding headcount and absorbing inflation like everyone else. While a 3% quarterly bump isn’t terrible, it does mean any stall in revenue flows straight to weaker earnings. With NII plateauing, even modest expense growth can eat into profits. The efficiency ratio isn’t given outright, but the trend suggests it likely ticked up slightly (which means efficiency ticked down). This contributes to profitability stagnation in the near term.

To sum up Q1: Third Coast delivered a good quarter on an absolute basis and a great quarter on a year-over-year basis, but the sequential numbers show a business hitting a near-term plateau. Growth is slowing to a more normal pace, and profitability isn’t accelerating like it once was.

Why I’m Closing the Position: Slowing Growth & No Near-Term Catalyst

Given that backdrop, why sell now? In a phrase: opportunity cost. While I remain impressed with TCBX’s operation, I don’t see a catalyst in the next couple of quarters that would significantly juice the stock price. Here’s my thinking:

Point #1. Loan & Deposit Growth Deceleration

The investment case was built on rapid growth. That story has changed. We’re now looking at mid-single-digit loan growth and even some deposit contraction (at least in the recent quarter) instead of the double-digit growth of yesteryear. Management’s 8% loan growth target for 2025 is perfectly fine for a mature bank, but it’s not exciting. It means TCBX will grow roughly in line with the better-performing regional banks, not vastly faster. Without outsized growth, it’s hard for a growth-driven stock to outperform. In stock investing, if the growth thesis goes lukewarm, the stock usually follows suit.

Point #2. Stagnant Near-Term Profitability

The bank’s profits have flatlined sequentially. Yes, they’re at a decent level, but I was expecting a continued climb. Instead, net income has been hovering in the ~$12M/quarter range for three quarters now. ROE around 12% is good, not great — and if ROE isn’t expanding further, the price-to-book multiple is unlikely to expand either. Basically, without earnings acceleration, the stock may lack upward momentum.

The slight NIM uptick from securitization (a clever move, by the way) will help Q2 a tad, but it’s a one-time bump. Beyond that, there’s no obvious catalyst to drive a big earnings surprise. In fact, if funding costs creep up or credit costs normalize from ultra-low levels, earnings could even stall or dip a bit in subsequent quarters. I don’t foresee an earnings breakout in the next 6-12 months.

Point #3. Valuation and No Hype Trigger

TCBX isn’t extremely cheap nor extremely expensive — it’s somewhere in the middle. At ~$32/share, it trades for around 0.9x book value and roughly 10x forward earnings. That’s reasonable, but to see quick gains, we’d need a blowout quarter, which I don’t see on the horizon. The company’s strategic moves (like the loan securitization) are smart but won’t make headlines on CNBC.

The guidance for “stabilization” in deposits and steady growth is basically a signal that nothing dramatic is expected in the near term, neither amazing nor terrible. And with banking sentiment still lukewarm (many investors are cautious on banks in general right now), a middling growth outlook means the stock could continue to drift.

Point #4. Better Uses of Capital

Perhaps most importantly, I have other fish to fry — or rather, other stocks that look more appetizing right now. Holding TCBX ties up capital that could be working harder elsewhere. I’d rather deploy this cash into an opportunity with a clearer catalyst or more obvious undervaluation.

Just yesterday I shared a new idea with my paid subscribers that could be a 4x-9x multibagger. Compared to that idea, TCBX feels like it’ll be treading water for a while. My decision isn’t because TCBX is a bad bank; it’s because my money has an opportunity cost. I can’t just judge an investment in isolation — I have to compare it to what else I could do with that cash. And right now, I see a juicier reward-to-risk trade-off in another deep dive idea, so I’m making the swap.

Point #5. Risk Management — Avoiding Complacency

One more angle: the broader banking sector still faces some headwinds – high interest costs, potential recession credit risks, etc. TCBX has navigated these well so far, but if I’m not expecting much upside, why stick around and subject myself to those macro risks? By redeploying to a different industry/stock with nearer-term catalysts, I also diversify away some financial-sector risk. Sometimes the best move is to trim when the tide isn’t favourable.

In short, the thesis has shifted. I bought TCBX for high growth and rising profitability. I’m now seeing moderate growth and flat profitability. The company is still good, but the stock no longer offers the same compelling risk/reward, especially given the alternatives available in the market today.

Thank you for reading, and here’s to always learning and looking for the next opportunity!

Feel free to hit reply with your thoughts on TCBX or any questions — I’m always happy to hear from you all.

Happy investing,

~ George