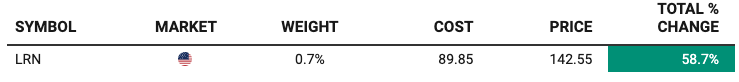

Stride Inc. (LRN) Stock Deep Dive: Why It’s Up 59%—And Still Has 57% Upside From Here

This $2.3B online education stock is transforming K–12 and career learning—and trading at just 13× earnings with rising free cash flow.

Updates:

Nov2’25: Q3 2025 Earnings Results & Revised target price ($224 → $209)

Aug10’25: Q2 2025 Earnings Results

Last week, I came across a post on Instagram. At first glance, it looked like a typical giveaway—“We’re giving away $100,000!” What caught me off guard wasn’t the claim itself (those are a dime a dozen), but something else entirely.

Can you spot it?

Still haven’t seen it? Give it another look. Here's a tip: focus on the description.

I hope you've found it by now.

How anyone could think that $1,000 weekly for a year totals $100,000 boggles my mind. Perhaps there was some hidden footnote explaining a special prize or that they were hiding $1,000 twice a week(though I couldn’t find one), or maybe the error was intentional to drive engagement. Who knows?

Or maybe the explanation is simpler: someone might have missed their basic math classes.

COVID-19 caused many students to fall through the cracks. Sure, classes eventually moved online, but the shift took time, and not every student made the transition successfully. Maybe the person who wrote that Instagram post missed some foundational math lessons and still carries that knowledge gap today.

I encountered a similar situation just last week when speaking with someone who should have known better.

Let me first ask you this:

You can find the correct answer in the footnote1.

Well, I was reviewing a document prepared by this individual, and the reported ROIC was lower than I expected. Curious, I asked him how he calculated it. His response? TTM NOPAT divided by the ending balance of invested capital, arguing that every resource and financial platform calculates it that way.

Another example of a kid who might have fallen through the cracks during the pandemic?

I am a strong believer in education, I believe education can bring peace and reconciliation. Education can help us ensure we live meaningful lives even as AI reshapes our jobs and ultimately allows us to experience greater fulfillment.

I still remember the thrill of discovering online learning after finishing university. Even today in my 40s, I devour courses on Udemy, Coursera, and LinkedIn Learning to keep my skills sharp and explore new interests. I even created my own online investment course.

As a lifelong learner and now a father, I’ve become a true believer in online education, not just for career skills, but for flexible schooling at every age. When I started considering schooling options that fit our living situation (We are trying to avoid the cold winters in Canada, so we are planning to spend the Canadian winter in warmer countries), I started researching virtual K-12 programs.

That journey led me to Stride, Inc. (NYSE: LRN 0.00%↑), a leader in online education for kindergarten through career. I was impressed by Stride’s scale and vision to “redefine lifelong learning.” I first bought Stride stock under $90 per share, convinced it was an overlooked gem in stock investing.

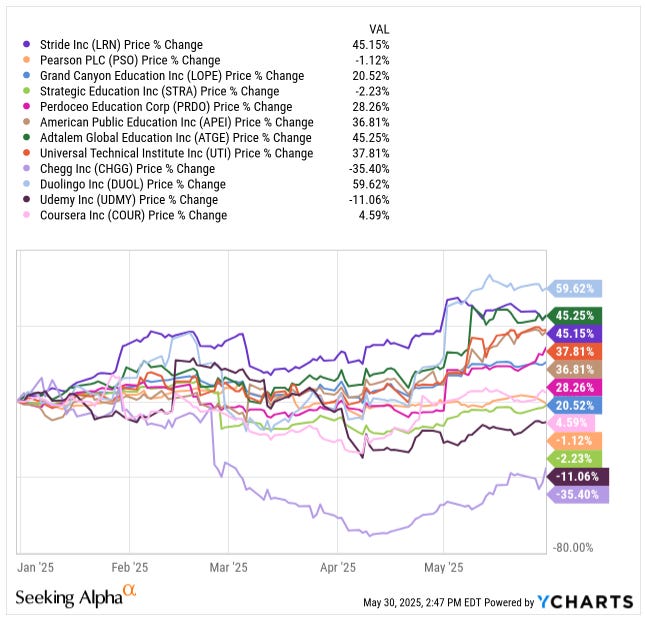

Today, the stock trades around $143, meaning paid subscribers who joined me are up roughly 59% on this pick.

Despite that run, I’m still bullish: I see Stride as a long-term winner riding secular trends in education. My price target is $224, supported by strong enrollment growth, improving profits, and a reasonable valuation for a high-growth business.

Let’s dive into why Stride can continue to beat the market’s tide.

Table of Contents:

Industry Landscape: Online K-12 and Career Education on the Rise

Financials & Valuation: Growth, Cash Flow, and Upside Potential

Brief Investment Thesis

Stride is transforming education by leading the shift to online K-12 and career learning. The company’s General Education segment provides stable, contracted revenue from virtual K-12 schools, while the faster-growing Career Learning segment taps into soaring demand for job-focused education.

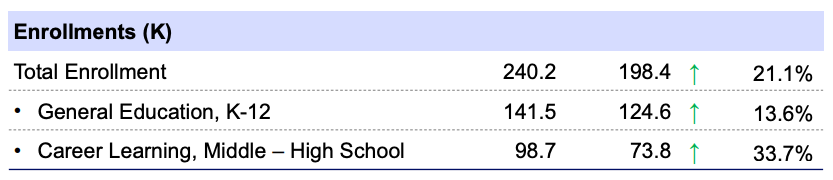

With record enrollments (total students up 21% in Q1 2025) and expanding margins, Stride’s earnings are compounding rapidly.

Despite ~49% YTD stock gains, Stride stock still trades at 13x EBITDA and 22x trailing earnings — a reasonable valuation for a company that has grown EPS 62% annually for the past 5 years.

Free cash flow is strong (>$200M annually) and management’s five-year targets imply substantial upside by FY2028. In short, Stride offers a rare combination of secular growth, improving profitability, and a still-underappreciated business model in the massive education market.

Business Overview: Two Segments Powering Lifelong Learning

Stride, Inc. is an education services company on a mission to “redefine lifelong learning”. If the name doesn’t sound familiar, you might remember it as K12 Inc. — the company rebranded to “Stride” in late 2020 to reflect a broadened focus beyond just K-12. Today, Stride operates two main segments that together serve learners from kindergarten through adulthood:

General Education (Gen Ed)

This is Stride’s legacy core — comprehensive online education for K–12 students. The company partners with public school districts, charter boards, and families to provide virtual K-12 schooling (primarily under state virtual academies or charter programs).

Stride offers a full “school-as-a-service” model: curriculum, certified teachers, technology platforms, administrative support — basically an end-to-end online school solution. Most students are enrolled in tuition-free online public schools powered by Stride (funded via state per-pupil dollars), often as an alternative to traditional schools for reasons like safety, health, flexibility, or learning needs.

Contracts with school partners typically last 5–7 years and boast +90% retention rates, making this a sticky, recurring revenue stream. Stride also runs several private online schools (tuition-based) in states without free virtual public options.

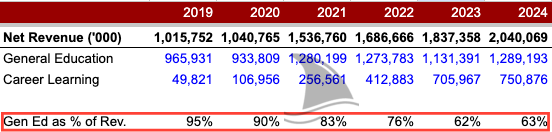

Additionally, Stride can provide pieces of its K-12 solution “à la carte” (branded as Learning Solutions) — selling curriculum or tech to districts that run their own virtual programs. However, full-service virtual schools remain the bulk of General Ed revenue. In FY2024, General Education contributed about 63% of Stride’s $2.04 billion revenue, providing the stable foundation of the business.

Career Learning

This newer segment is Stride’s growth engine. It encompasses career-focused education for two groups — middle/high school students and adult learners. At the secondary level, Stride operates Stride Career Prep programs (often integrated into its virtual high schools) that allow students to take career-oriented electives in fields like IT, healthcare, and business alongside their core K-12 curriculum.

High schoolers in these programs can earn industry certifications (e.g. IT support, medical billing), college credits, and even get internship/apprenticeship opportunities — giving them a head start on careers without necessarily pursuing a four-year college. Stride now has 55 career-oriented schools/programs across 27 states serving middle and high school students. This is a unique offering in the K-12 landscape, meeting a growing desire for career and technical education (CTE) at the high school level.

The second piece of the segment is Adult Learning, which Stride expanded via acquisitions of several adult career training companies in 2020. These include Galvanize (coding bootcamps and data science training), Tech Elevator (software engineering bootcamps), and MedCerts (online healthcare and IT certification programs).

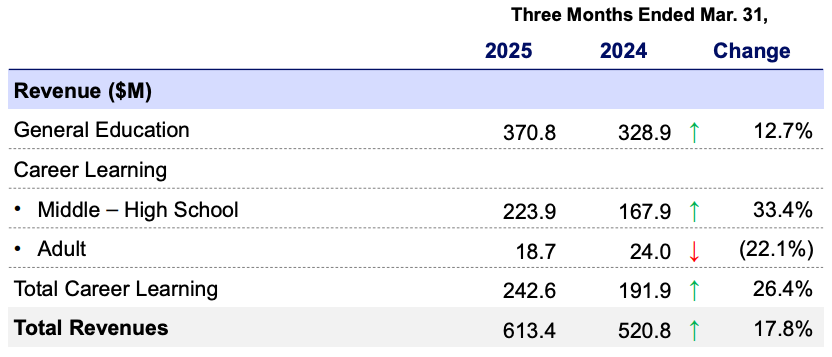

Through these brands, Stride offers short-term skill training programs for adult learners, both direct-to-consumer and via employer partnerships. Together, the K-12 career programs and adult training make up the Career Learning segment. It’s been growing rapidly — Career Learning revenue jumped 26% y/y in Q3 FY2025 (to $242.6M for the quarter) — and now accounts for ~37–40% of Stride’s total revenue.

However, growth is lopsided: the middle/high school career programs are booming (33% y/y revenue growth in Q3, to $223.9M) while Adult Learning has faced headwinds (Q3 adult revenue down 22% y/y to $18.7M). We’ll discuss why that adult sub-segment is lagging later, but the big picture is clear — Stride’s future lies in Career Learning.

How does Stride make money from these segments?

In General Ed, revenue primarily comes from public funding per student. When a student enrolls in a Stride-powered online public school, the state education dollars follow, and Stride receives a fee (per its contract) to educate that student. Stride’s revenue per enrollment in General Ed is around $2,500 per quarter.

This can vary by state funding levels and services provided, but importantly, per-student funding for virtual schools is often ~30% lower than for traditional schools (because virtual schools have lower expenses). That cost efficiency is part of Stride’s value proposition — states can educate some students for less money, and Stride can still earn a margin by operating at scale.

In Career Learning’s K-12 programs, funding also comes via public education dollars when those career courses are part of a student’s school program. Stride noted an average of ~$2,269 revenue per Career Learning enrollment in recent quarters.

For Adult Learning, revenue is more direct — fees paid by individual learners or employer clients for training programs. For example, Galvanize sells coding bootcamp seats, and MedCerts might contract with workforce agencies or companies to train workers. In sum, Stride’s business model is a hybrid of education-as-a-service (to public institutions) and direct consumer/professional education. Contracts with schools (public and private) yield multi-year recurring revenue, while consumer-facing programs add a growth kicker (with some cyclical risk).

It’s worth highlighting just how sticky and scalable Stride’s model has become. The K-12 partnerships often span +5 years, and Stride boasts +90% renewal rates on these contracts. Many partner schools have been with Stride for over a decade, growing their enrollments over time. Stride provides the curriculum (including both core academics and electives), the learning platform, and manages teacher hiring/training in many cases.

This creates high switching costs — a school district would find it difficult to replicate or replace Stride’s full-service solution. On the cost side, Stride enjoys economies of scale on curriculum development and tech infrastructure. The company has developed a vast library of online courses and proprietary platforms over the last +20 years. With ~230,000 students currently enrolled across all programs, Stride can spread content and R&D costs over a large base. This scale and first-mover advantage (Stride was founded in 2000 and effectively created the online K-12 category) have made it the market leader in U.S. virtual schooling. As we’ll see, the pandemic dramatically accelerated adoption of online K-12, and Stride was ready to capitalize.

Revenue Mix

Historically, General Ed was the vast majority of Stride’s revenue (and indeed the company’s original name “K12 Inc.” reflects that focus). As recently as FY2018–2019, Career Learning (then mostly nascent) was only ~5% of revenue. But the mix has shifted rapidly:

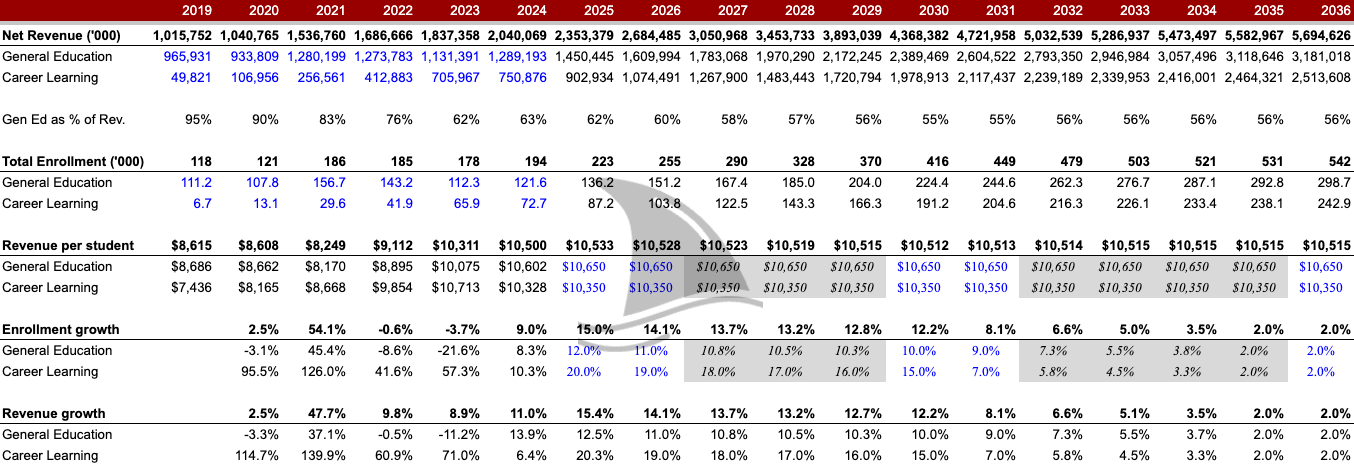

As the table shows, Career Learning has exploded from $50M in 2019 to $750M in 2024 — an astounding 15x increase in five years. Management noted this business “grew from $0 to over $700 million in only five years” as students increasingly seek career-oriented education. The General Ed segment had a bump in FY2021–2022 (from the COVID-driven online school surge) and then a pullback as brick-and-mortar schools reopened, but appears to be on a growth track again (General Ed rev rose 13% in the first 9 months of FY2025).

Going forward, I expect General Ed to grow at a modest single-digit rate (driven by gradual adoption of online school options in more states), while Career Learning can grow double-digits (with high school career programs gaining popularity and adult training rebounding post-recession). Stride’s long-term vision is clearly to expand beyond the K-12 market and serve learners “from kindergarten through adulthood” — hence the name Stride (as in lifelong strides in learning).

Industry Landscape: Online K-12 and Career Education on the Rise

To appreciate Stride’s opportunity, it’s important to understand the education industry context it operates in, particularly in the U.S. K-12 education system and the broader career training market.

K–12 Online Education in the U.S.

The concept of virtual K-12 schooling was relatively niche pre-2020. Stride (then K12 Inc.) and a competitor called Connections Academy (owned by Pearson) were the primary players partnering with states on online charter schools. These programs appealed to a subset of students, such as elite athletes, child actors, kids with medical issues, or those seeking an alternative learning environment free from bullying or rigid schedules.

Pre-2020, nationwide K-12 online enrollment was flattish for years, reflecting that it hadn’t yet gone mainstream. Then came the COVID-19 pandemic, a seismic catalyst. In 2020, every student in America was suddenly exposed to remote learning. Parents and school districts scrambled to implement online education, often with mixed results, given the chaos. But one outcome was increased awareness and acceptance of online schooling as a viable option. Many families realized that full-time online school could be a safer, more flexible, and personalized alternative to traditional schools. As evidence: by 2022, full-time online K-12 enrollment (virtual charters and district-run programs) had risen ~90% from the pre-pandemic level.

Coming out of the pandemic, public school enrollment overall has declined (more on this in Risks), but the share of students in online schools has greatly expanded. Every state now has some form of virtual schooling. Stride, being the largest provider, benefited immensely: its enrollments surged in 2020–2021. While some of that was temporary (students later returned to physical schools), many families have stuck with online education or continue to choose it each year. Stride noted that online K-12 enrollment stayed ~90% higher in 2022 vs. 2019 — indicating a permanent step-change.

There is also a growing ecosystem of virtual and hybrid schools beyond Stride’s network, including district-run online academies and smaller operators. Competition in K-12 online ed primarily comes from:

Pearson’s Connections Academy PSO 0.00%↑, which operates virtual schools in +30 states (though still 15–45% smaller than Stride’s presence);

Certain regional players like ACCEL Schools (a private company running online charters in ~12 states); and

States’ own initiatives utilizing free open-source digital curriculum (so-called Open Education Resources).

Despite these competitors, Stride remains the market leader — it’s essentially the “AWS of online schools,” providing the backend for many state programs.

Another trend boosting online K-12 is the increase in homeschooling and microschools post-pandemic. Some parents pulled kids from public schools and seek structured curricula to homeschool or form small learning pods.

Stride can capture some of this through selling its curriculum directly (Learning Solutions) or via its career-focused private programs. All told, while traditional public schools still educate ~50 million children, online programs are carving out a growing niche. Even if only e.g. 2–5% of students ultimately enroll in full-time online school, that’s a TAM of 1–2.5 million students in the U.S. — versus ~141,500 full-time K-12 students Stride serves today.

This doesn’t even count the millions more who might take just a few online courses or career modules (blended learning). In short, Stride’s K-12 business is riding a secular trend: more families demanding online program alternatives and more states embracing school choice to fund them.

Career Learning and Workforce Education

The second part of Stride’s industry landscape is career and technical education (CTE), both at the secondary (high school) level and adult level. This is a huge, fragmented market spanning high schools, community colleges, trade schools, bootcamps, corporate training, online course providers, and more.

High School Career Tech

In the U.S., vocational classes and career-oriented programs have existed in high schools for decades (think shop class, auto repair, etc.), but there’s a renewed push to expand CTE pathways as an alternative to the “college for all” mentality.

According to the National Center for Education Statistics, nearly 85% of high school graduates in 2019 earned at least one credit in a CTE course. In the 2019–20 school year, about 7.6 million secondary students (roughly half of U.S. high schoolers) participated in CTE programs. So the majority of teens are exposed to some career-related curriculum.

However, much of that happens in traditional schools. Stride saw an opportunity to offer these courses in an online, scalable format — and to give ambitious students a chance to graduate high school with job-ready credentials. The Stride Career Prep program is essentially an online vocational school layered on top of a regular diploma. It’s relatively unique.

While some states have their own virtual CTE initiatives, Stride’s multi-state footprint and industry partnerships (with companies offering internships, etc.) give it an edge in breadth of offerings. The demand for such programs is rising as families seek cost-effective alternatives to a 4-year college. Not every student wants to take on college debt; some prefer to start working earlier with skills in coding, healthcare, skilled trades, etc. Stride enables that choice, and states are supportive because it aligns education with workforce needs.

To gauge TAM

There are about 15 million high school students in the U.S. If even, say, 10% of them eventually enroll in a Stride-style career program (full or part-time), that’d be 1.5 million students. Using Stride’s current revenue per career student per quarter (~$2,269) as a benchmark, that’s a potential ~$13.6 billion annual revenue opportunity — versus ~$800 million run-rate for Stride’s middle/high school Career segment in FY2025 (my estimate).

Even more conservatively, 5% penetration of high schoolers would imply ~$6.8B TAM for Stride’s career K-12 programs. In other words, Stride has tapped only a single-digit percentage of its K-12 career education opportunity. And that’s within the U.S. alone; Stride could eventually offer similar programs internationally (it already reaches students in 100+ countries with various products).

Adult Career Training

The adult learning market is massive. Broadly defined, Americans spend tens of billions on postsecondary training outside of traditional college. This ranges from community college workforce programs to coding bootcamps, to employer-funded corporate training, to online course marketplaces like Coursera/Udemy, etc.

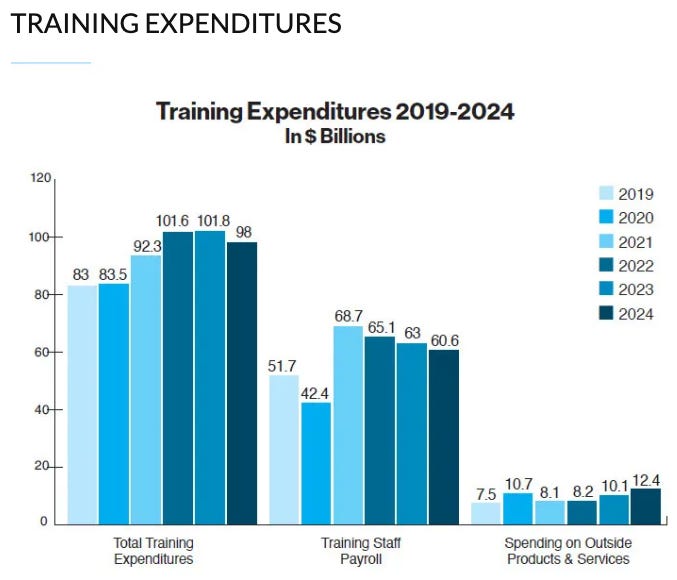

U.S. companies alone spend over $98 billion per year on employee training and development — a staggering figure that underscores how much ongoing education happens on the job.

Stride isn’t targeting all of that (much is internal training), but it gives a sense of scale. More directly relevant is the fast-growing bootcamp and certificate sector. For example, the global coding bootcamp market is projected to reach ~$660 million in 2024 and ~$1.6 billion by 2033, growing at ~10% CAGR.

Stride’s Galvanize and Tech Elevator are players in that space (though Galvanize struggled initially after Stride’s acquisition). Healthcare and IT certification programs (like MedCerts offers) also address a huge need — there are persistent shortages of medical technicians, IT support specialists, etc., and those roles often require short-term training, not college degrees.

During economic downturns, the adult training industry can be cyclical (people may postpone upskilling, and companies cut training budgets). We saw this recently: Stride’s Adult Learning revenues have dipped as individuals and employers tightened spending. However, the long-term trend is favourable: the labour market is constantly evolving, and workers need to reskill/reskill more frequently than in the past.

Online and blended learning for adults is increasingly accepted — witness the growth of Coursera (COUR 0.00%↑) and Udemy (UDMY 0.00%↑), or corporate e-learning which is a +$100B global market. Stride’s niche is more structured, accredited programs (as opposed to casual MOOCs): its bootcamps and certifications often come with career services and recognized credentials. This can justify a premium price and better outcomes.

One important dynamic: Stride’s adult programs often target middle-skill careers that are in high demand (e.g. coding, medical assistant, pharmacy tech). By integrating those offerings with its high school pipeline, Stride creates a continuum of career education. A student could do Stride Career Prep in high school, then go straight into a Galvanize bootcamp or MedCerts program, and land a job by age 20 — all under the Stride umbrella.

That is a powerful model if they can execute on it, effectively becoming a talent developer for the industry. Stride even works with employers directly (for instance, partnering with companies to train and place graduates). This aligns with a broader tailwind: employers increasingly value skills over degrees. Companies like Google (GOOG 0.00%↑) have launched their own certificate programs; Stride is positioning to provide skilled grads for the modern workforce.

In summary, the industry trends are on Stride’s side: K-12 schools are moving online (slowly but surely), career/skills training is booming, and online learning is mainstream for both kids and adults now. Stride sits at the intersection of these trends, with a first-mover advantage in K-12 and a growing foothold in adult ed. The total addressable market is enormous — effectively the $740 billion U.S. education market (from K-12 through adult), a slice of which is transitioning to digital delivery. Even capturing a few percent of that over time would make Stride multiples larger than it is today.

Financials & Valuation: Growth, Cash Flow, and Upside Potential

Now let’s turn to Stride’s financial performance and why I believe the stock remains an attractive investment even after its recent appreciation.

Strong Growth and Improving Profitability

Enrollment growth is the lifeblood of Stride’s revenue. Fortunately, those numbers have been very robust. By Q3 FY2025, Stride’s total enrollments grew 21% y/y, with General Education enrollment up 13.6% to 141.5k students and Career Learning enrollment up 33.7% to 98.7k students. This fueled a 12.7% y/y increase in revenue for the quarter.

For perspective, overall K-12 public school enrollment is declining (2.5% drop since 2019), so Stride is clearly gaining share in a shrinking market — a testament to the secular shift to online and the company’s execution.

Notably, Career Learning (K-12) has been the growth standout, with enrollments up ~31% in Q2 and ~34% in Q3 of FY2025. This reflects the strong demand for Stride’s career-oriented high school programs. General Ed enrollments are growing around 10–13% y/y, which is impressive too — it suggests many families still newly choosing online school even post-pandemic.

The one weak spot is Adult Learning enrollments, which Stride doesn’t publicly report in number terms, but we see the revenue decline (–22% yoy in Q3). Management has cited economic factors: when the economy or job market weakens, individuals are less likely to pay for bootcamps, and employers scale back tuition assistance programs. I expect a rebound in adult segment growth when conditions normalize — a potential cyclical upside ahead.

On the revenue per enrollment side, things are stable. In Q3 FY25, Stride’s overall revenue per student per quarter was ~$2,415, roughly flat YoY. General Ed rev/student ticked up 0.4% to $2,516, while Career Learning rev/student dipped 0.1% to $2,269.

This slight mix shift (career students bring a bit less revenue on average) isn’t concerning — both figures are in line with historical funding levels. The key is that Stride can grow revenue largely by growing students, without needing to substantially raise prices (which are mostly dictated by state funding anyway). The visibility into revenue is also good: with average student tenure and contract retention high, a large portion of each year’s enrollment is effectively “renewals” plus new wins.

Now, what about profits? This is where the story gets even better. Stride historically was run more like an education outfit than a lean business — it barely made GAAP profits in the 2010s.

However, since CEO James Rhyu took over in 2021, there’s been a laser focus on efficiency and margin. The results speak for themselves:

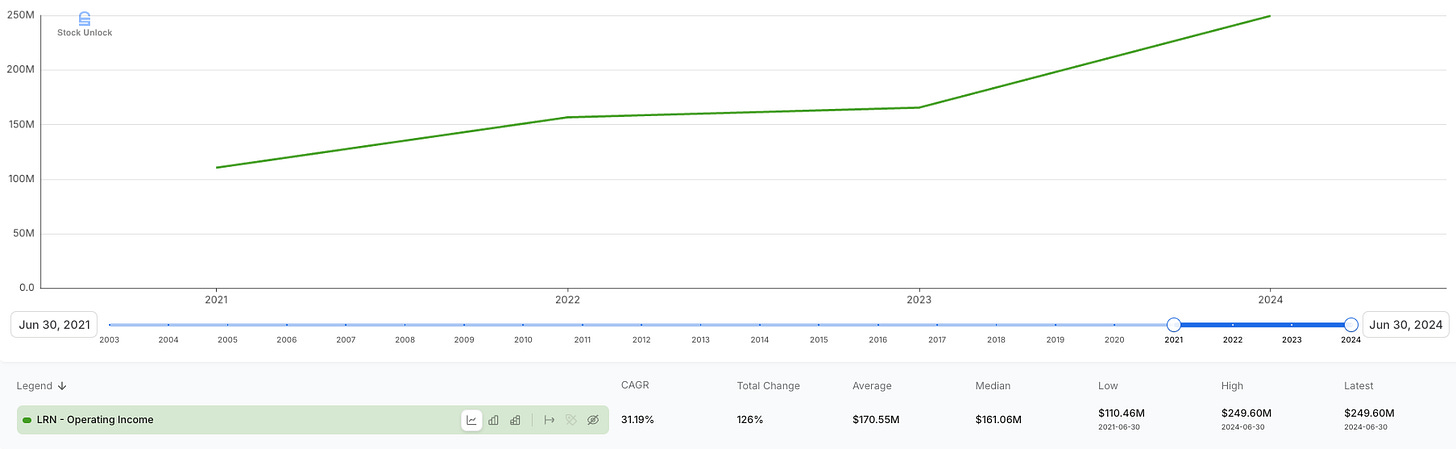

Operating Income

Operating Income was $250M ($293M adj.) in FY2024, up from $110M ($146M adj.) in FY2021 — essentially doubling in three years.

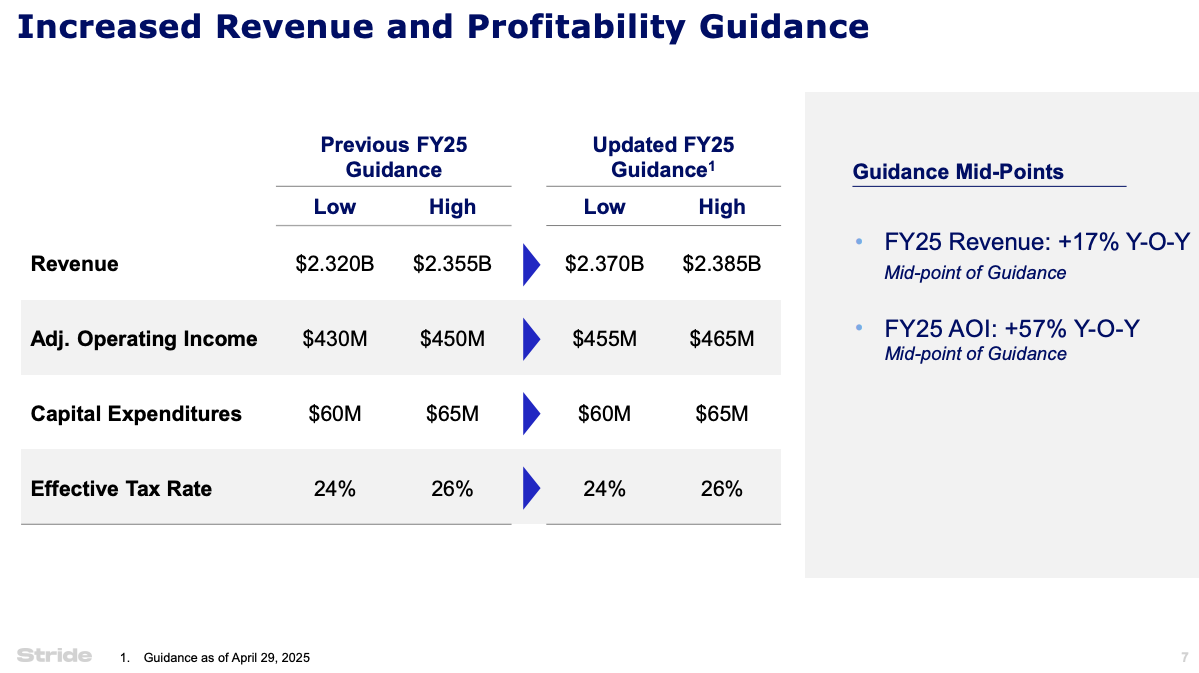

For FY2025, the company just raised its adjusted operating income outlook to $455–$465M. That’s ~55% YoY growth on top of last year’s double! The adjusted operating margin is expanding rapidly (targeting ~19–20% in FY25 vs ~14% in FY24).

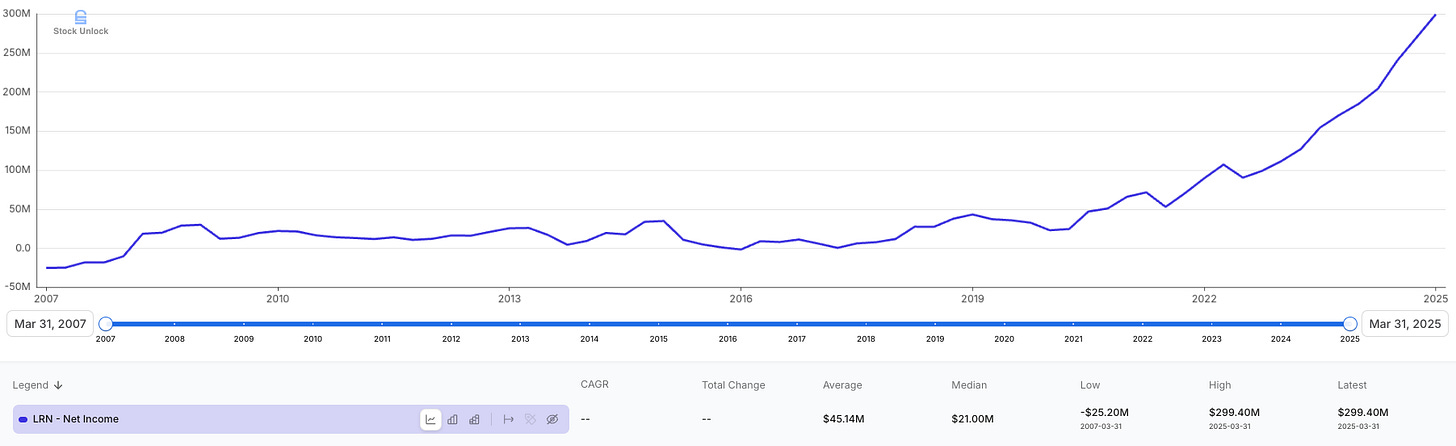

Net Income

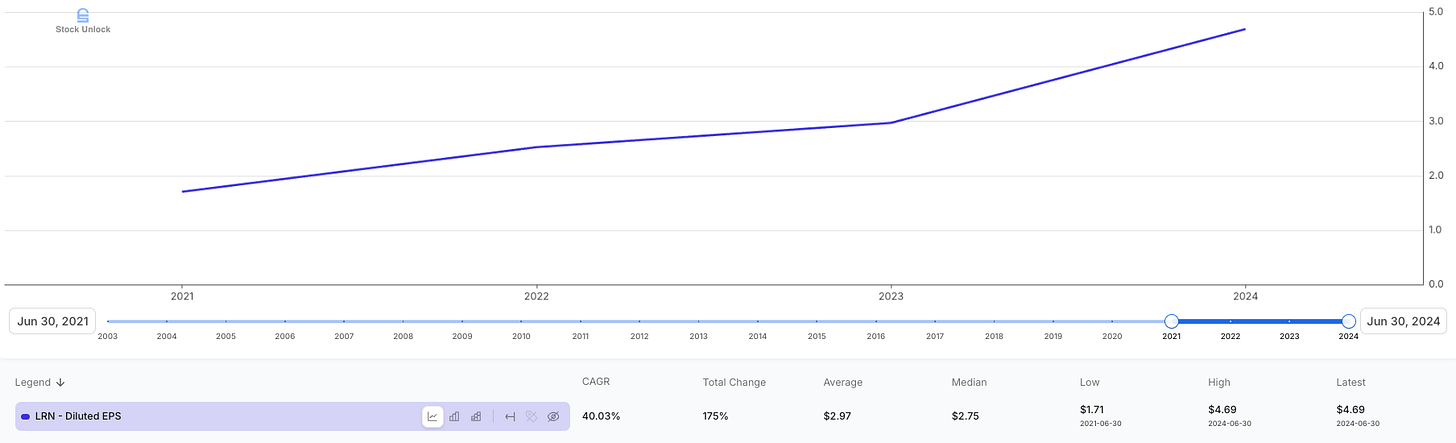

Net income in FY2024 was $204.2M, up 61% from $126.9M in FY2023. Diluted EPS for FY2024 came in at $4.69 (up from $2.97 in FY23 and $2.52 in FY22).

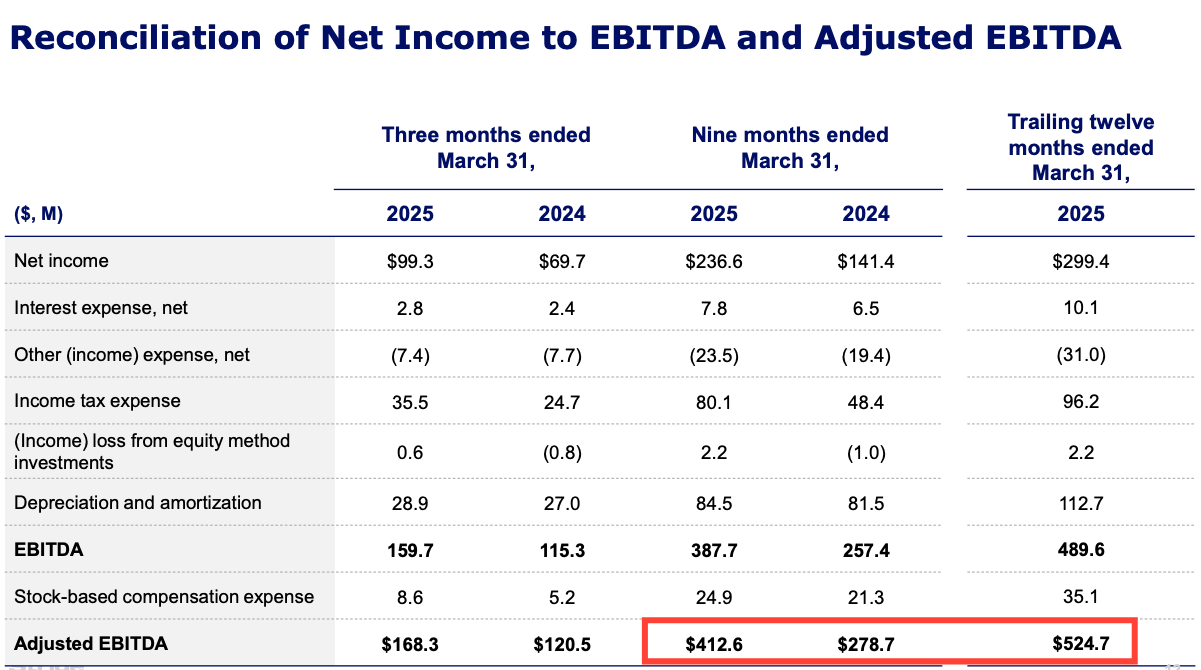

Management doesn’t give explicit EPS guidance, but with the operating income raise and some tax benefit, FY2025 EPS could approach $6. In Q3 FY25 alone, net income was $99.3M, nearly double the prior year’s quarter.

EBITDA

EBITDA (adjusted) was $413M for the first nine months of FY2025 (up from $279M for the same period in 2024). Full-year adjusted EBITDA is likely to be ~$540M or higher.

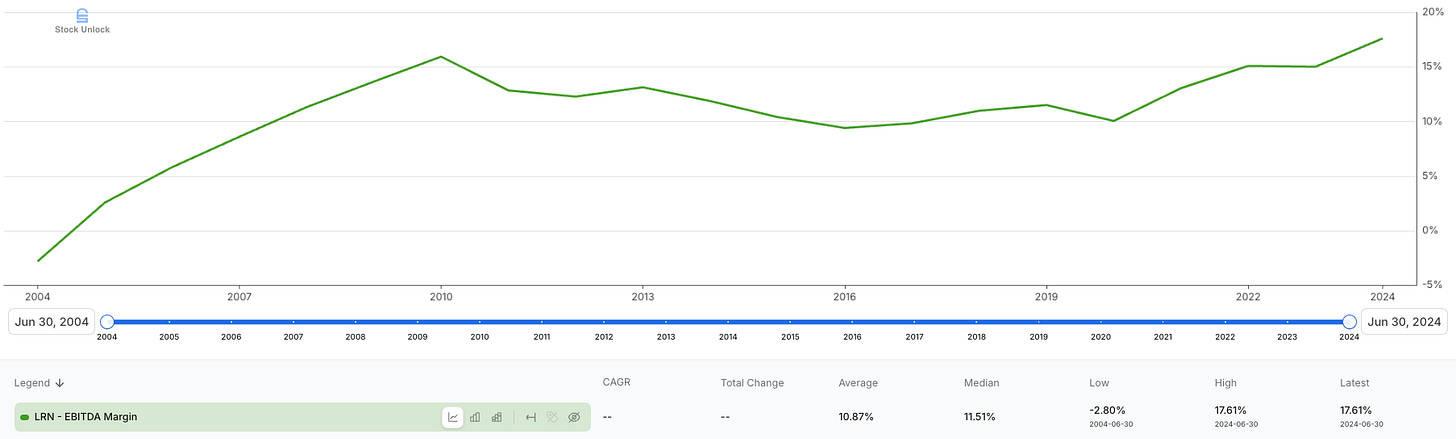

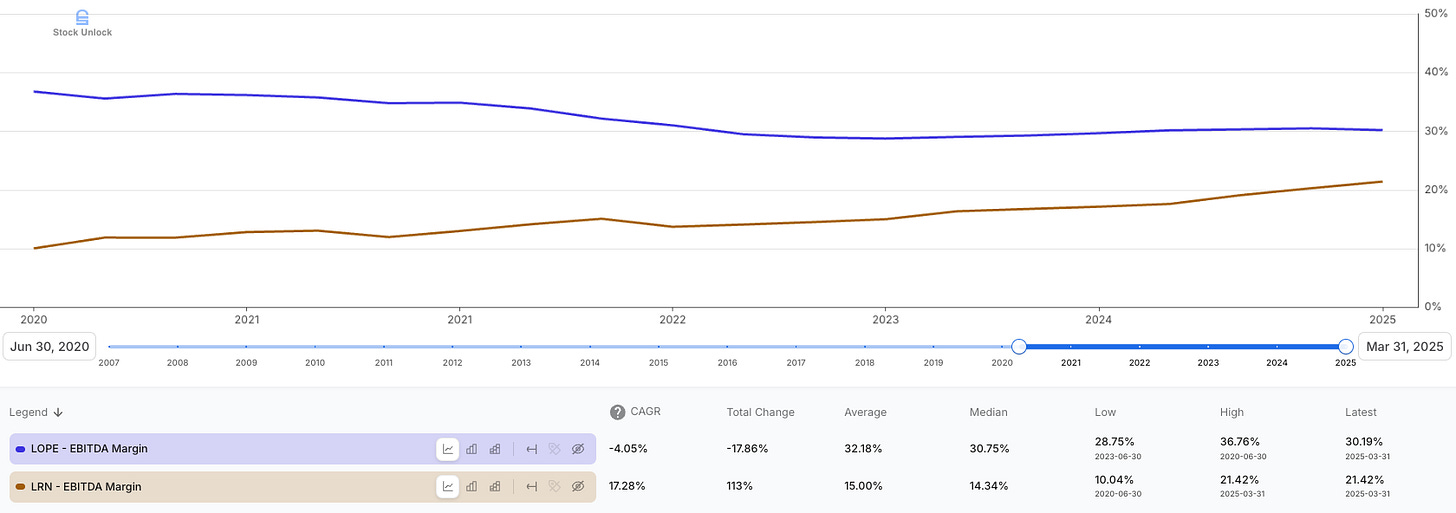

Stride’s EBITDA margin has improved significantly, reaching 17.6% as of FY2024, up from 12–13% in the years leading up to 2020, and well above the low of –2.8% reported in 2004. For much of the 2010s, margins hovered in the 10–13% range, showing little operating leverage despite growing revenues. But over the last few years, the pivot to Career Learning, better cost control, and operating discipline post-COVID have meaningfully boosted profitability. The upward trajectory since FY2020 reflects stronger student economics, scaled platforms, and exit from underperforming business lines. Stride is now operating at its highest EBITDA margin in 20+ years, with room to expand further as the business mix continues to shift toward higher-margin offerings.

To put it simply, Stride has gone from a low-margin, slow-growth company to a higher-margin, high-growth company under current management. It’s a rare turnaround in the for-profit education sector, which is typically plagued by either low growth or poor margins (or both).

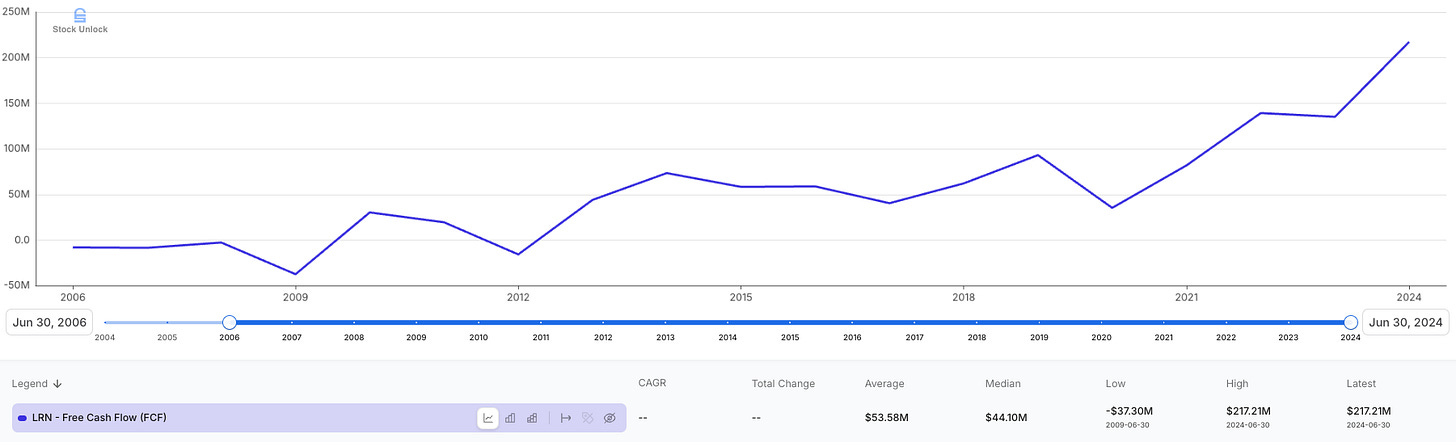

FCF is also strong and growing. In FY2024, cash from operations was $278.8M. Capex were around $60M (Stride guides $60–65M capex annually). That yields FCF of roughly $220M for FY24. In FY2023, CFO was $203M and capex ~$65M, so FCF ~$138M. Clearly, FY24 saw a big jump. Stride’s business is not very capital-intensive: most capex is for developing software and digital curriculum (which they capitalize on the balance sheet) and for providing laptops/materials to students.

They expensed about $33M on student computer depreciation in FY24, indicating ongoing investment in devices, but these costs scale roughly with enrollment (and can be managed via leasing, etc.). With operating profits rising, FCF should continue to ramp up. I expect FY2025 FCF to be in the $200–250M range. That puts the stock at about a 3.0–4.0% FCF yield at current prices. Stride’s FCF conversion is good because it has minimal working capital needs (it often gets paid upfront via state funding cycles, which can even create positive deferred revenue).

One more notable item: Stride carries net cash on its balance sheet. As of Dec 31, 2024, it had $738M in cash and marketable securities. Debt is only a $420M convertible note due 2027 (at 1.125% interest). Net cash position is thus around +$300 million. This provides flexibility for growth investments or share buybacks.

In fact, with the stock price strength, I wouldn’t be surprised if management starts leaning into repurchases. They’ve hinted at using their ~$0.7B net cash war chest to capitalize on the undervalued stock. Buybacks could add a nice tailwind to EPS growth (and offset any dilution from that convertible note if/when it eventually converts).

Updated FY2025 Outlook and Beyond

Stride’s latest guidance (post-Q3 FY2025) underscores how well the business is doing. They forecast FY25 revenue of $2.37–2.385B, up ~16.5% y/y. This is above prior guidance and implies a strong Q4. Adjusted operating income guidance is $455–465M as mentioned (a hefty ~19% margin at midpoint). These raises came on the back of record Q3 results and momentum in Career enrollments.

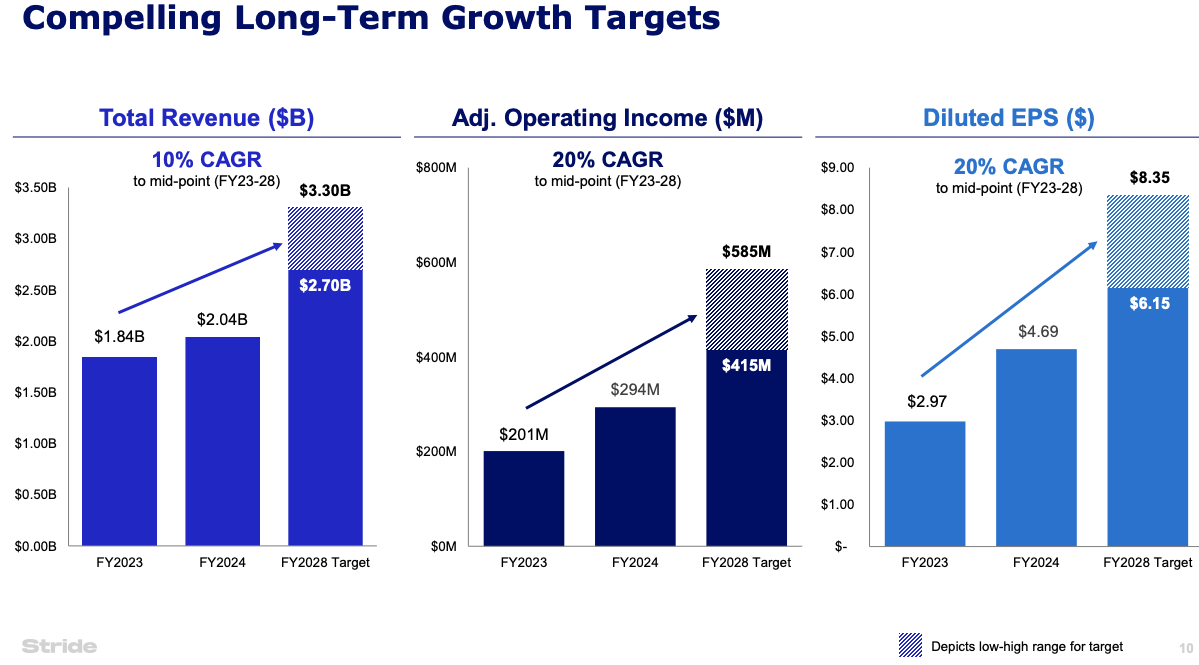

Looking longer term, management has shared FY2028 targets (set last year) that give a sense of their ambition: $2.7–3.3B revenue by FY28 (CAGR ~10% from FY23’s $1.84B) and $415–585M in adjusted operating income by FY28 (CAGR ~20%). They also projected EPS of $6.15–8.35 in FY2028 (also a ~20% CAGR from FY23).

These are aggressive goals, but notably Stride is already ahead of pace on the profit side — it may hit the lower end of that op income range ($415M) in FY25, three years early. The revenue target of ~$3B by 2028 seems achievable if current growth (15%+) continues for a couple more years before moderating to high-single digits. Given FY25 will be ~$2.38B, reaching even $2.8B by FY28 would only require ~5.5% CAGR from FY25 — likely too conservative considering Career Learning can easily grow double digits. In short, I see upside to the revenue goal and I think management does too (they set what they thought were reasonable targets).

If Stride hits, say, $3.0B revenue and +$500M operating profit by 2028, the earnings per share would likely be well above $8 (depending on buybacks). For reference, the mid-point FY28 EPS target ($7.25) at a 20x P/E would imply a stock price of $145 in 2028. But we’re already past that in 2025! Clearly the market has re-rated Stride higher as growth came through. The key question: Is there still upside from here (around $143), or is it fully valued? Let’s tackle valuation next.

Valuation: Still Reasonable for the Growth (Target Price $224)

After a ~7x increase from pre-COVID to now, Stride’s stock isn’t the ultra-bargain it once was — but I believe it remains attractively valued relative to its growth prospects.

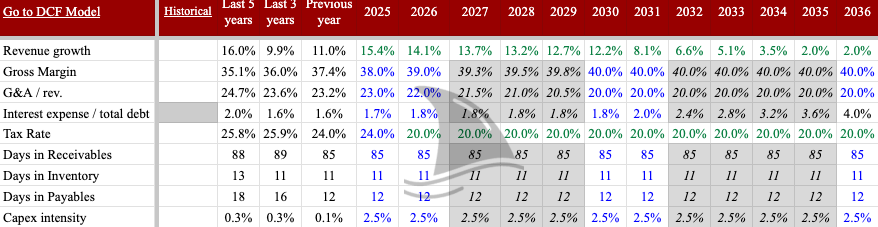

I assumed a WACC of 8.2%. I used an unlevered beta of 0.92, corrected for cash, based on the education industry. I also factored in an optimal debt-to-capital ratio of around 40%, aligning with typical industry standards for mature education-focused businesses.

First, let's talk revenue and enrollment growth. For General Education, I'm projecting enrollment growth to stay double-digit in the medium term and tapering gradually to around 2% annually by the mid-2030s. Career Learning is the real growth driver here, I expect growth to be in the high double digits in the medium term before slowing gradually to 2% long-term growth as the segment matures.

These assumptions reflect industry forecasts and Stride’s current momentum. The overall online K-12 education market is expected to grow around 14% annually, supporting my growth figures.

I assume that Stride’s growth will lag the industry’s as Stride will gradually lose some market share, acknowledging intensifying competition from established players like Pearson, TAL, and newer entrants like Duolingo and Coursera.

Despite the competitive environment, Stride’s Career Learning segment should continue to capture increasing market share due to its early-mover advantage and comprehensive career readiness offerings.

On margins, I’ve projected gross margins gradually expanding from 37.4% today to a steady-state of 40% by 2030, driven by scale advantages in Career Learning and continuous efficiency improvements. Operating leverage should become increasingly evident as Career Learning grows.

Capex intensity is modelled at around 2.5% of revenue long-term, a prudent estimate considering ongoing investments in technology platforms and course content to sustain growth and competitive differentiation.

Using these assumptions, the fair value based on this DCF model is approximately $224 per share, almost 57% from current levels. That gives us ample room for appreciation as the market better appreciates Stride's robust growth trajectory and improving profitability.

Secular Risks: Demographics, Politics, and Other Headwinds

No stock analysis would be complete without examining the risks. Stride is not without challenges — some macro, some company-specific. Let’s address the big secular risk that often comes up: U.S. demographic trends, i.e. a declining youth population.

Fewer Kids = Fewer Students?

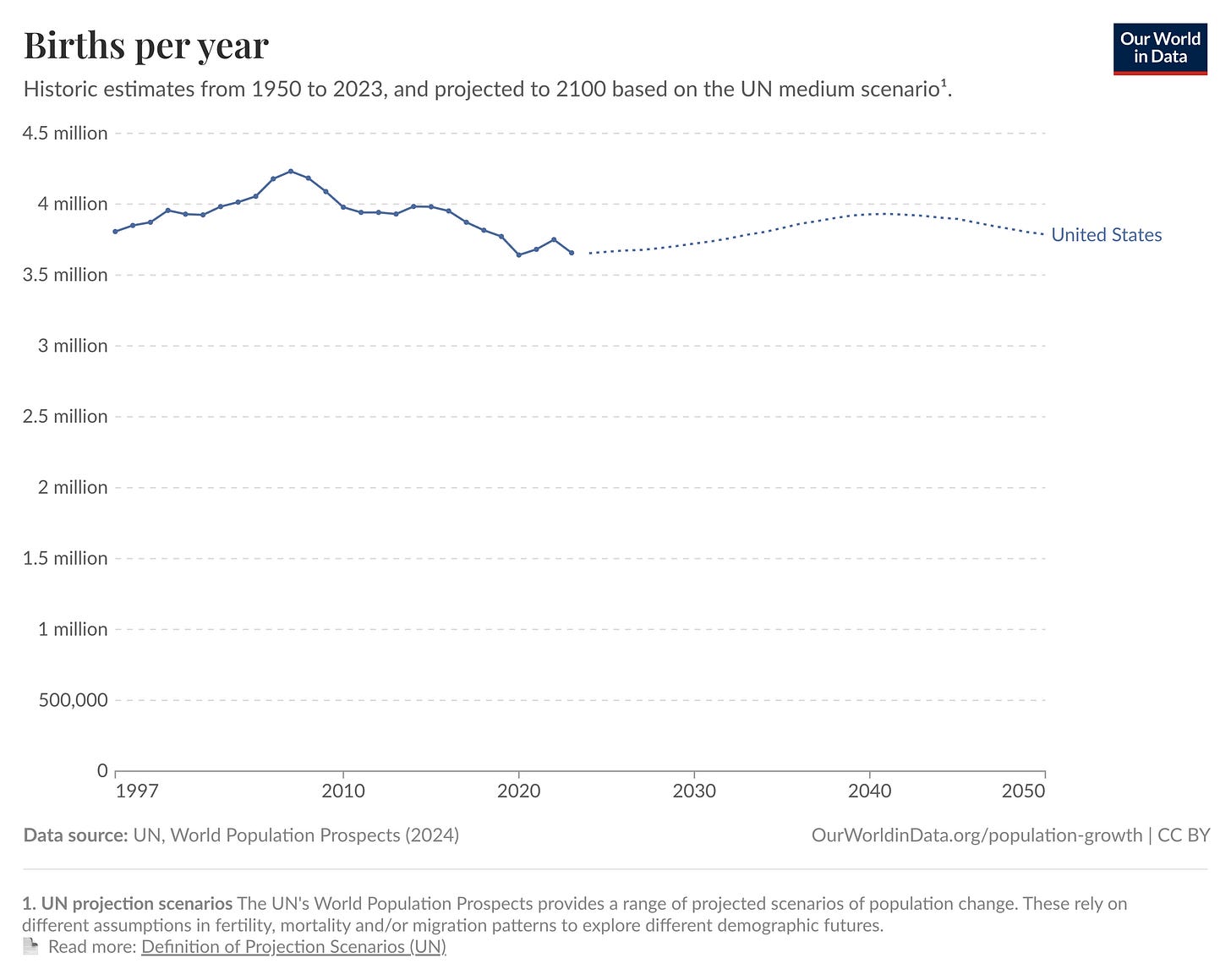

It’s true that birth rates in the U.S. have been falling for over a decade. The number of U.S. births dropped 13% from 2007 to 2023 (from 4.23 million births to 3.66 million).

That “birth dearth” means smaller kindergarten cohorts entering school each year. The pandemic briefly bumped fertility in 2021, but it resumed decline — births fell another 2% from 2022 to 2023. The impact on K-12 enrollment is already being felt: public school K-12 enrollment is projected to drop by 2.7 million (about –5.5%) from 2022 to 2031 as those smaller cohorts move through the system.

Fewer school-age children can translate to lower demand for educational services overall, including online programs. For a company like Stride that earns revenue per enrollee, a shrinking pool of potential enrollees is a headwind.

While the UN projects birth to recover a bit, I am pessimistic, especially with the headwinds that immigration is facing in the US.

However, there are several mitigating factors to consider:

Share Shift vs. Absolute Decline: Even if the total number of students is decreasing ~0.5% per year, Stride can (and has been) gaining share within that universe. The traditional public school system is hemorrhaging students, not just because of demographics but due to competition from charters, private schools, homeschooling, and virtual options. For example, in the last few years, ~40% of the 1.2 million drop in public school enrollment was from families opting out (homeschool, etc.). This presents an opportunity: Stride can capture some of those opting out by offering an appealing alternative to brick-and-mortar schools. In other words, Stride’s slice of the pie can grow even if the pie shrinks a bit. The company’s ~142k K-12 students are still <0.3% of U.S. K-12 enrollment (49.5M as of 2023). If that rose to 1% or 2%, it would more than offset a few percent decline in total students.

Adult Learning Expansion: The demographic challenge really only hits the K-12 side. Stride’s Career Learning for adults faces a very different demographic reality: the U.S. adult population is not shrinking, and the need for upskilling spans all ages. In fact, declining birth rates eventually lead to labour shortages, which increases pressure to train and retrain workers to boost productivity. Stride is wisely diversifying into adult education, which can become a larger portion of revenue over time. That provides a secular offset — educating an age 35 worker can compensate for one less 3rd grader, so to speak. Additionally, adult programs are more flexible globally; Stride could train international students (no birth dearth in some emerging markets) via online courses.

Immigration as a Wildcard: Immigration is one of the biggest wildcards when thinking about the future of U.S. school enrollments. Historically, immigrant families have helped offset declining birth rates—bringing in not just workers but also school-age children. But even that trend has slowed. Fertility rates among immigrants have dropped, and the current administration hasn’t exactly rolled out the welcome mat. In fact, we’re seeing the opposite: stricter immigration enforcement and policies that, over time, may shrink the pipeline of young families moving to the U.S.

That said, pendulums swing. If the consequences of pushing immigrants out—shrinking workforce, fewer students, slower economic growth—become more obvious, we could see a political course correction. A future Democratic administration might loosen immigration again, especially if it’s framed as an economic necessity. Some politicians have even floated ideas like incentivizing higher birth rates or targeting high-skilled immigration to counter what they’re calling the “enrollment cliff.”

Stride can’t control any of this, of course. But it stands to benefit if the U.S. stops the bleeding on its young population. More kids means more demand for flexible education options—and Stride is well positioned to meet that demand.

Per-Pupil Funding Trends: A related risk to fewer kids is funding pressure. Schools get funded per student; when enrollment drops, budgets tighten, and districts could be less willing to pay outside providers. However, the flip side is that many districts faced with fixed costs (teachers, buildings) and falling headcounts are looking for creative solutions — sometimes closing schools, or moving programs online to cut costs. Stride can pitch itself as a solution for districts dealing with teacher shortages or low enrollment: for example, rather than hiring a physics teacher for 5 students, a small district might enroll those kids in an online course via Stride. If anything, tight school finances might encourage more use of third-party online programs that are cost-efficient. Plus, education spending tends to be resilient (public K-12 funding generally increases annually, and was boosted by federal COVID relief recently). There is the possibility of political changes (e.g. reduced budgets or voucher programs affecting funding flows), but the fundamental need to educate kids isn’t going away.

Beyond demographics, there are other risks and challenges to flag:

Regulatory and Political Risk

Education is a heavily regulated space. Stride’s fortunes can be influenced by government policies at both the state and federal levels. For instance, expansions of charter school laws or school choice programs (like Education Savings Accounts) in states can open new markets for Stride, while conversely, any backlash against virtual charters could restrict growth.

So far, the trend has been more states allowing online charters, but there is scrutiny. Some lawmakers worry about for-profit providers in public education. Stride faces a lingering distrust from those who recall early controversies about virtual charter performance. The company must continually prove its quality outcomes to avoid regulatory crackdowns.

There’s also a scenario where a state caps or reduces funding for online schools if test results lag — that would directly hurt revenue. On the federal side, education policy can swing with administrations. The current environment under Biden hasn’t impeded Stride (if anything, online learning has bipartisan support as an option).

But hypothetically, a future push for stricter oversight on for-profit education or changes to virtual charter funding formulas are risks. It’s interesting that even under the Trump administration, which proposed eliminating the Department of Education, Stride wasn’t negatively impacted — K-12 funding is mostly state-level anyway.

The key is Stride must navigate 50 sets of state regulations and maintain good relationships with authorizers. This risk is somewhat mitigated by Stride’s geographic diversity; an issue in one state (say, a charter non-renewal) wouldn’t collapse the business, though it could dent growth.

Academic Outcomes and Reputation

Ultimately, Stride’s success depends on students and parents finding value in its programs. Education outcomes (test scores, graduation rates, career placements) are closely watched. Virtual schools nationally have had mixed academic results historically, drawing criticism.

If Stride’s schools don’t perform well, it can threaten contract renewals or growth. The company has worked to improve student support, and its accountability metrics have improved, but it’s an ongoing challenge to deliver quality at scale.

Similarly, for career programs: if employers don’t find Stride graduates to be job-ready, that value prop diminishes. Stride guarantees some outcomes (they’ve even had a guarantee that if a child doesn’t read by 3rd grade, they’ll pay for remediation) — which is great, but means they need to hit those marks.

Cyclical/Market Risk

As noted, the Adult Learning segment is economically sensitive. If we enter a deeper recession, Stride’s bootcamp enrollments might slip further as people postpone upskilling or can’t afford programs.

Also, Stride’s stock has run up a lot; it now sports a higher valuation than in the past. That leaves less margin for error. Any quarterly miss (e.g. slower enrollment growth or unexpected costs) could trigger a sharp stock pullback — the stock could drop 20-30% in a heartbeat if the market senses growth slowing.

I’ve seen this in the past with education stocks — they can be volatile around enrollment seasons. You should be prepared for some bumps, even if the long-term trajectory is positive.

Competitive Landscape: How Stride Stacks Up

Stride occupies an interesting position at the crossroads of education and technology, which means its competition comes from several different directions. Let’s survey the landscape of competitors and peers, and see how Stride differentiates itself:

K-12 Focused Peers:

Connections Academy (Pearson PLC)

As mentioned, Pearson’s Connections Academy is the most similar competitor in operating online K-12 schools. Pearson ( PSO 0.00%↑) is a huge education publisher, and Connections is just one division, so it doesn’t get the same attention. Connections’ enrollment is about 15% below Stride’s in General Ed, and 45% lower in total (likely because Stride’s career enrollments put it ahead). Connections have good quality but fewer career offerings. Stride’s edge is having both core and career curriculum breadth, plus the advantage of focus (Pearson has many irons in the fire). Pearson trades close to 18x earnings with low growth — not a direct comp in valuation due to its different business mix.

Charter Schools & School Districts

The “competitor” for a student is often just the local public school or a nonprofit charter. Brick-and-mortar public schools are essentially Stride’s competition in the sense that a student leaving a traditional school to go online is a lost enrollment for them. With public schools facing their own challenges (teacher shortages, budget issues, etc.), some are launching virtual programs or contracting companies like Stride. We may see more districts choose to partner rather than compete. Stride has a partnership model (some states allow district-run online programs using Stride curriculum), which turns potential competitors into clients.

ACCEL / Pansophic Learning

This is a private competitor founded by Stride’s founder (Ron Packard) after he left K12 Inc. ACCEL runs online and blended schools in a dozen states, reportedly serving ~30k students. They remain much smaller and private equity-backed. Stride’s scale and public listing likely give it more resources to invest in tech and compliance, which many school boards would favour.

Nonprofit & University Programs

Entities like Florida Virtual School (state-run) or university-affiliated online high schools (some universities operate online high school diplomas) also dot the landscape. These tend to be region-specific. Stride’s nationwide presence and turn-key services make it a go-to for states that don’t want to build from scratch.

Higher Ed / Postsecondary Peers:

Grand Canyon Education (LOPE 0.00%↑)

LOPE is an interesting peer — it’s a former university that became a service provider. It runs Grand Canyon University (nonprofit) but provides services for it and other colleges. So it’s more in the OPM (online program manager) space for higher ed. Growth is moderate (~8%) and margins are high; LOPE trades at 24x earnings. While not a direct competitor, LOPE shows how profitable education services can be when scaled. Stride’s margin profile is approaching LOPE’s, but Stride has higher top-line growth. LOPE doesn’t do K-12 at all.

Strategic Education (STRA 0.00%↑) and Perdoceo (PRDO 0.00%↑)

These run for-profit universities (Strayer/Capella for STRA, AIU/CTU for PRDO) and some coding bootcamps. They target adult learners pursuing degrees or career diplomas. They have struggled with growth; enrollments are flat or declining in many programs as the for-profit college sector is mature. They trade at low P/Es (14-19x) as quasi “cash cow” businesses. Stride distinguishes itself by focusing on non-degree credentials (faster, cheaper pathways) and by having a K-12 pipeline. I view traditional for-profit colleges as less of a threat to Stride’s market and more as legacy players that could even partner with Stride (for instance, Stride could feed students into a community college or vice versa).

American Public Education (APEI 0.00%↑)

This small-cap operates American Public University (online college) and also acquired a nursing school chain (Hondros College) and a coding bootcamp (OpenClassrooms partnership). APEI has had a rough time with integration and military enrollment declines. Not a major threat to Stride.

Adtalem Global Ed (ATGE 0.00%↑)

Adtalem (formerly DeVry) focuses on medical and nursing education (owns Chamberlain University, etc.). It’s more specialized but has stable demand. ATGE stock is up ~44% YTD and trades 20x earnings. Again, not a direct competitor, but if Stride wanted to expand into nursing schools, ATGE is the incumbent. For now, Stride’s MedCerts targets the shorter-term certs, not full nursing degrees.

Universal Technical Institute (UTI 0.00%↑)

UTI runs trade schools for auto mechanics, welding, etc. That’s hands-on training, not online, but it appeals to the same demographic of career-seekers. UTI has done okay recently (stock +35% YTD) and even acquired a coding bootcamp to diversify. Their challenge is scalability and cyclicality (enrollment tied to economic cycles). Stride’s fully online model might have more operating leverage and agility.

Consumer EdTech Peers:

Chegg (CHGG 0.00%↑)

Chegg is known for textbook rentals and its homework help subscription. It’s a post-secondary student services company. Chegg’s growth stalled and stock plunged this year due to AI (students might use ChatGPT instead of Chegg). While not a competitor in K-12, Chegg shows the cautionary tale of edtech disruption — you have to keep evolving. Chegg trades at 2.4x EBITDA but with an uncertain outlook. Stride is different in that it provides full courses and instruction, not just study aids. If anything, Stride might incorporate AI into tutoring or grading over time to enhance its services (management has mentioned using AI to augment teachers).

Duolingo (DUOL 0.00%↑)

Duolingo (thank you for helping me brushing on my Portuguese) is one of the hottest names in edtech—a global, consumer-facing language app built on a freemium model. It only just turned profitable in 2023, despite generating ~$810 million in revenue (compared to Stride’s ~$2.3 billion). Yet the market gives it rockstar status. Duolingo trades at a staggering 28× sales with a $23 billion market cap, while Stride trades at just 2.9x sales.

Sure, it’s not apples-to-apples—Duolingo is a high-margin consumer tech platform scaling globally, while Stride operates in the more regulated U.S. education space. But the gap in valuation is striking. It shows how the market rewards growth narratives over actual cash flow. There’s little direct competition today, but one day Stride could even partner with Duolingo to offer language courses to its students.

Udemy (UDMY 0.00%↑) and Coursera (COUR 0.00%↑)

These are online course marketplaces/MOOC providers. They target adult learners seeking either casual learning (Udemy) or more structured credentials (Coursera, which partners with universities). They are more complementary than competitive to Stride. In fact, a Stride high school student could use Coursera to take a college-level class.

Both UDMY and COUR are growing revenues 20% to 30% annually since 2019 but not profitable yet. They are trading at 1.5-2.5x sales. Stride’s differentiated advantage is its live instruction and accredited programs — Udemy can’t grant a high school diploma or a state-approved certificate, and Coursera mostly serves higher-ed/continuing ed markets.

If anything, the success of those platforms validates adults’ willingness to learn online, which helps Stride’s case when marketing MedCerts or Tech Elevator programs.

Bright Horizons (BFAM 0.00%↑) and KinderCare (KLC 0.00%↑)

These companies focus on early childhood education and childcare, which doesn't directly overlap with Stride's K–12 virtual model but are often grouped together under the “education stocks” umbrella.

With a market cap of approximately $7.3 billion, BFAM operates employer-sponsored daycare centers and trades at around 45x earnings. The company boasts very reliable revenue streams.

Now a public company trading under the ticker KLC, KinderCare went public in October 2024, raising $576 million in its IPO. The company operates over 1,500 centers and 900 before-and-after school sites across 40 states and the District of Columbia, with a capacity for more than 200,000 children.

While Stride isn't in the daycare business, one could argue that Stride has a more scalable model—without the need for physical centers—and potentially higher growth, which might justify a premium valuation if it achieves similar predictability.

Graham Holdings (GHC 0.00%↑)

GHC (formerly Washington Post Co.) is a conglomerate that owns Kaplan (test prep and other education businesses) along with media and other assets. Kaplan has an online high school and does a lot in test prep and OPM for universities. GHC trades at a value-investor discount (sum of parts story). Kaplan’s presence means Graham is a competitor in various niches, but again, not focused on K-12 full-time schooling like Stride.

2U, Inc. (OTC: TWOU)

2U was once a high-flying edtech company, partnering with top universities to deliver online degree programs and owning the MOOC platform edX. However, after years of aggressive expansion, mounting debt, and intensifying competition, 2U filed for Chapter 11 bankruptcy in July 2024. The company emerged from bankruptcy in September 2024 as a private entity, having shed over $500 million in debt.

This serves as a cautionary tale. The OPM market became crowded, and universities began renegotiating deals or bringing programs in-house. Stride wisely avoided the OPM model, opting instead for direct-to-consumer training acquisitions.

While 2U isn't a direct competitor, its trajectory offers insights into the online higher education sector's challenges. It also underscores the importance of prudent financial management—Stride's acquisitions were relatively modest ($165M, $24M, $70M), positioning it for sustainable growth without overextending.

Competitive Advantage: After surveying these peers, Stride’s moats become clearer. In K-12, it’s scale, relationships, and comprehensive services — not many can replicate 20 years of curriculum development aligned to state standards and the trust built with education boards. In career/bootcamps, Stride’s edge is perhaps its distribution (ability to cross-sell to its K-12 base) and a broad portfolio (IT + healthcare, etc., plus employer ties). Stride is almost alone in straddling K-12 and adult segments, which gives it a unique lifelong learning model. Competitors typically focus on one or the other.

Stride is also unique: it’s one of the few pure-play publicly traded K-12 education companies. That can make it harder to find direct comps for valuation. But interestingly, Stride has outperformed all of the above-mentioned peers in stock performance except for Duolingo.

Over a longer period (last 5 years), Stride is up ~300%, whereas many for-profit educators are flat or down. This reflects a market realization that Stride’s model (with COVID tailwinds) is superior to the old for-profit college model.

Going forward, I expect moderate competitive pressure but nothing Stride can’t handle. The biggest “competitor” to worry about, frankly, is if the public education system decides to heavily invest in their own online capabilities, reducing the need for companies like Stride. So far, many schools have tried and struggled, which is why they outsource to Stride or Connections. Stride just has to stay ahead on user experience and student outcomes to maintain its lead.

Risks and Rewards Summary

To synthesize, here are the key risks to watch and the rewards that make the case for staying invested:

Risks:

Demographic Decline

Fewer kids due to lower birth rates could gradually shrink K-12 demand. Mitigated by share gains and adult segment growth.

Regulatory Changes

Online charter funding or for-profit participation rules could tighten under different political climates. Stride must keep good performance and compliance to avoid being targeted.

Adult Segment Volatility

The Adult Career Learning business is economically sensitive — recessions or weak job markets can reduce enrollment and revenue. Stride needs to weather these cycles and balance growth across segments.

Execution & Integration

Rapid growth and acquisitions pose execution risks — e.g., integrating new technologies, maintaining education quality at scale, and achieving promised synergies. A misstep (like a tech platform outage or a failed acquisition integration) could hurt the brand.

Great question—and good catch on the dilution risk. Based on the content and flow of your current thesis, the best place to insert this would be in the “Risks and Rewards Summary” section, right after the “Execution & Integration” risk and before “Stock Valuation & Volatility.”

Here’s a draft of the new section you can plug in:

Share Dilution Risk

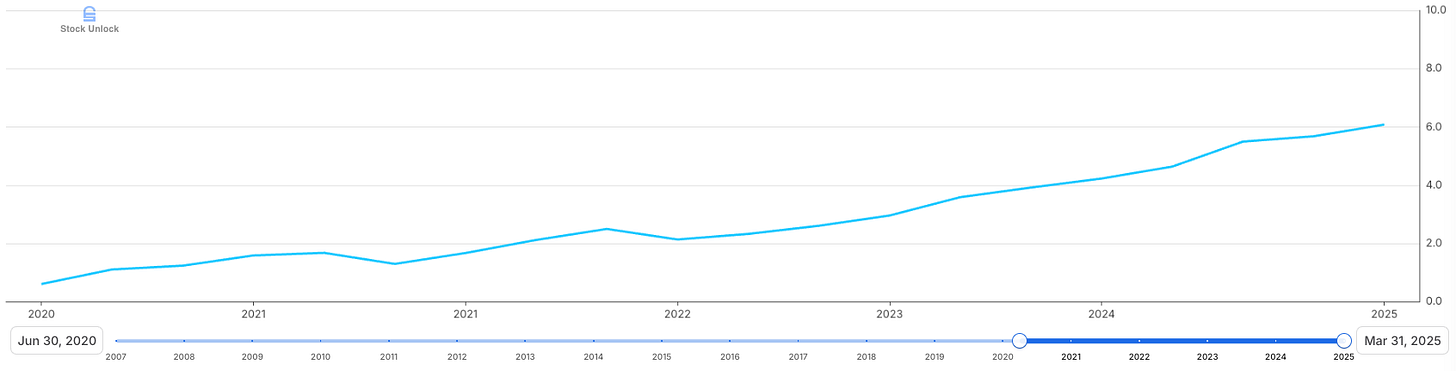

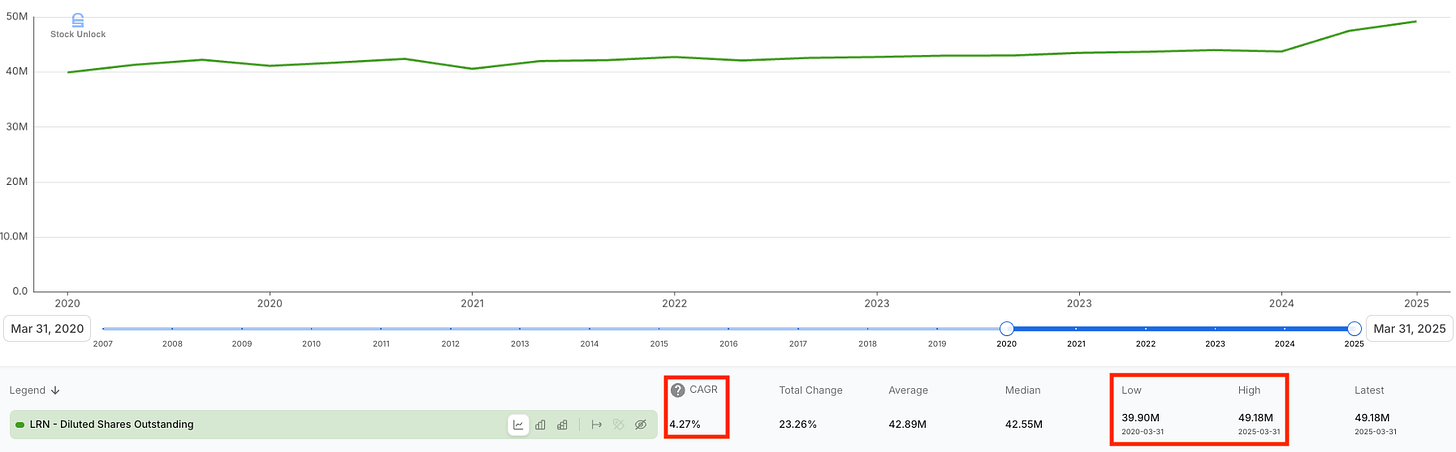

One under-the-radar but important risk: Stride’s share count has been rising. Over the past five years, diluted shares outstanding have grown at a 4.3% annualized rate, increasing from ~39.9M to ~49.2M shares. That’s a 23% total dilution, which does impact per-share metrics like EPS and FCF/share.

This dilution is driven by the stock-based compensation structure and the lack of active buybacks until recently.

Also, the convertible debt (the $420M note due 2027) may eventually convert, further diluting shareholders if the stock price remains strong.

The good news? Stride has $738M in cash and investments and has publicly stated it may begin repurchasing shares to offset future dilution, especially now that profitability and cash flow are robust.

Dilution hasn’t been enough to derail the investment case so far—EPS is still growing rapidly—but it’s worth watching. If Stride leans harder into buybacks in FY2025–2026, it could become a positive catalyst. But until then, expect some share creep to persist.

Stock Valuation & Volatility

After a big run, the stock may be prone to pullbacks. Expectations are higher now; any slowdown in growth (even seasonal) might cause an outsized stock reaction. Investors need to be able to ride out volatility.

Rewards:

Secular Growth Tailwinds

Stride is on the right side of long-term trends — the shift to online learning, emphasis on career skills, and school choice expansion all support a growing market for its services.

Market Leader Advantage

With the largest enrollment base and most comprehensive offerings, Stride benefits from scale economies and a strong reputation. This creates a virtuous cycle (more students -> more data -> improved curriculum -> attracts more students).

Improving Financial Profile

The transformation under current management means higher margins, strong cash flows, and a cash-rich balance sheet. Stride today is a profit machine compared to its past, enabling reinvestment and shareholder returns (potential buybacks/dividends ahead).

Visibility and Recurring Revenue

The multi-year school contracts and recurring nature of education give decent revenue visibility. This is not a here-today-gone-tomorrow fad; enrollment tends to stick. That lowers risk and supports a higher valuation.

Upside Optionality

Stride has several “call options” — e.g., if it succeeds wildly in adult upskilling, or if it expands internationally, or lands a major federal training initiative, those could add incremental growth beyond the base case. Also, if one segment falters, the other can pick up the slack (diversification across K-12 and adult).

Reasonable Valuation (PEG < 1)

Even after the rally, Stride trades at valuation multiples that don’t fully reflect its growth (PEG around 1). There is room for multiple expansion if the company continues to deliver +20% earnings growth and builds a track record (investors might eventually accord it a higher P/E more like a tech-enabled education firm than a traditional school operator).

In my view, the rewards outweigh the risks for Stride at this juncture. The company is executing well, and most risks are either longer-term (demographics) or manageable (regulatory, since Stride works closely with policymakers and has 20+ years of experience navigating this).

I will be vigilant — for example, if enrollment growth slowed to low-single digits, or if margins stalled, that would alter the thesis. But all current indicators (enrollment, guidance raises, etc.) show positive momentum.

Management & Leadership: Driving the Turnaround

A huge part of Stride’s success story is the leadership of CEO James Rhyu. Rhyu took the helm in January 2021, after serving as Stride’s CFO for 7 years and briefly as President of Corporate Strategy/Tech. His background is in finance and operations — prior to Stride he was CFO/CAO at Match.com and held senior finance roles at Dow Jones, Sirius XM, and Ernst & Young. This business-oriented mindset was exactly what Stride needed.

Under previous management, K12 Inc. often prioritized growth in enrollment without sufficient cost control and got entangled in political fights. James Rhyu brought a focus on financial discipline and accountability. He immediately changed the culture to be more metrics-driven and recruited executives from outside the traditional education world. The effect was dramatic: EPS tripled under Rhyu’s first three years of leadership. He also set bold targets (the FY2028 goals of 20% profit CAGR) that signalled ambition to investors.

One of Rhyu’s key moves was to diversify Stride beyond K-12. He spearheaded the acquisitions of Galvanize, Tech Elevator, and MedCerts in 2020 to jump-start the adult learning segment. While not all of those acquisitions were instant hits (Galvanize needed restructuring in 2021), over time, they have positioned Stride as a broader education company. Rhyu also pushed internally to develop the Stride Career Prep curriculum for high schools — a growth engine now. It’s clear he’s thinking about where education is heading, not just where it’s been.

Another positive under Rhyu is capital allocation. Stride historically hoarded cash and was wary of buybacks or dividends (perhaps due to regulatory scrutiny on for-profit education using funds for shareholder returns). But with nearly $740M in cash and investments on hand, and robust cash flow, I suspect management will consider uses of cash.

Rhyu has hinted at potentially repurchasing shares. In 2022, Stride authorized a $150M buyback (and started to execute on it modestly). I expect a more aggressive stance if the stock dips or if cash continues building. Having a CFO-turned-CEO often means a shareholder-friendly approach, and Rhyu’s track record so far supports that.

Stride’s CFO is now Donna Blackman (since 2022). She has 20+ years of experience as well (previously at organizations like the Olympics Committee). The fact that Rhyu moved up to CEO and brought in a new CFO allowed him to focus on strategy while still having a strong grip on financials through his background. The broader executive team includes seasoned folks in education management, technology, and academics. One example: Sandi Squicciarini (Head of Career Learning) came from outside traditional K-12, bringing a perspective of aligning education with workforce needs.

The Board of Directors includes experienced names like Craig Barrett (former Intel CEO) who adds tech credibility, and administrative leaders with education policy knowledge. So governance looks solid. One red flag in for-profit education is incentive misalignment (e.g., execs chasing enrollment at the cost of outcomes).

At Stride, management’s incentives seem to be balanced — part of their LTIP (long-term incentive plan) is tied to operating income performance and stock price performance, which aligns them with profitability and shareholder value. One tranche of their performance stock units vests based on a three-year stock price CAGR, which likely motivates them to drive the stock above certain thresholds by 2026. I like seeing that kind of alignment.

It’s also worth noting Rhyu’s personal story, which he’s shared in interviews: he was once a struggling student (self-described C student) who later found his footing, so he’s passionate about personalized education and the idea of serving “non-traditional” learners. That ethos is reflected in Stride’s mission to meet each learner’s needs. I find it compelling when a CEO has a genuine mission focus and a solid business head. Rhyu appears to have both.

Conclusion: Don’t Miss the Next 59%

I first bought Stride under $90—and paid subscribers were in early. Today, the stock is already up over 59%, and I still see meaningful upside ahead.

Gain = $110 - $100 = $10

Return on investment = gain / initial investment = $10 / $100 = 10%

Hi George, any updated insights on LRN with recent pending class action lawsuit? Thank you!

This was a fantastic write-up — I especially loved how you kicked things off with that example. Great lead in! I’m personally bullish on the education sector too, especially given how AI is about to reshape it. I think we’re heading toward a world where every student has their own personalized AI tutor.

On that note, I recently wrote a deep dive on CURI. At first glance, it might look like just another overvalued streaming company — but dig a little deeper and you’ll see they’ve quietly pivoted into licensing their factual documentary content (which they fully own) to train AI models. That segment is still relatively new, but it’s already responsible for over 50% of their revenue and played a key role in driving them to their first profitable quarter. Definitely one to watch.

https://sniperpearl.substack.com/p/curiositystream-curi?r=3lnljs